11 Free AI Tools For Small Business Owners

As a small business owner, your personality and people skills help you stand out from your competitors — but that...

What Is Reputation Marketing? The Ultimate Guide for Small Businesses

If your reputation precedes you, then reputation marketing would precede that. Reputation marketing is an excellent business strategy for entrepreneurs....

Build a Facebook Group Your Customers will Actually Engage With

By Liz Nickson Establishing a strong online presence is essential for businesses in today’s digital age. One powerful tool to...

Different Kinds of Customer Complaints: 5 Complainer Personality Types (and How to Deal with Them)

Customer complaints are an unavoidable part of business. Whether the blame lies with you or on circumstances beyond your control,...

Get more free content to help your business.

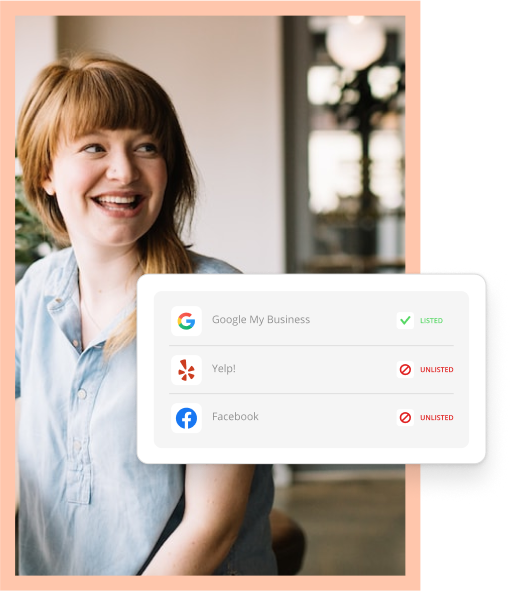

A great online presence is essential for your business– how does yours stack up?

Use our free analytics tool to see how your business compares to the competition and find out what customers are saying about you.

Learn how we will use your information

Privacy Notice: I consent to receiving a telephone call and/or electronic promotional and marketing messages from or on behalf of Thryv about its products and services. You can withdraw your consent at any time. You can contact us at [email protected], by opting-out of email marketing directly on our unsubscribe page, or at Thryv, 1155 Volunteer Pkwy, Suite 201, Bristol, TN 37620, USA . For more information on how we handle your personal information, please see our privacy policy.