Use ThryvPay for Free

You could save thousands on payment processing fees with ThryvPay

Online payment processing software built for your small business.

If you’re using a payment processor designed for retail businesses, you’re doing it wrong. Future proof your business with an online payment processor designed for small businesses.

- Easily accept credit card, ACH, and digital payments

- Get next-day funding

- Offset costs by automatically charging convenience fees

- Accept tips from your customers

- Integrate with QuickBooks for automatic reconciliation

- Stay safe with fraud prevention

Low payment processing rates with no hidden fees.

Control how much online payment processing truly costs your business. ThryvPay has some of the most competitive payment processing rates in the industry.

- Online payment processing rates start at 2.9% plus 30 cents per transaction.

- Card present processing rates start at 2.6% plus 30 cents per transaction.

ACH rates are a minimum of $1.00 or 1% up to maximum of $9.00

Watch Video

ThryvPay gives your business everything it needs to deliver on customer satisfaction.

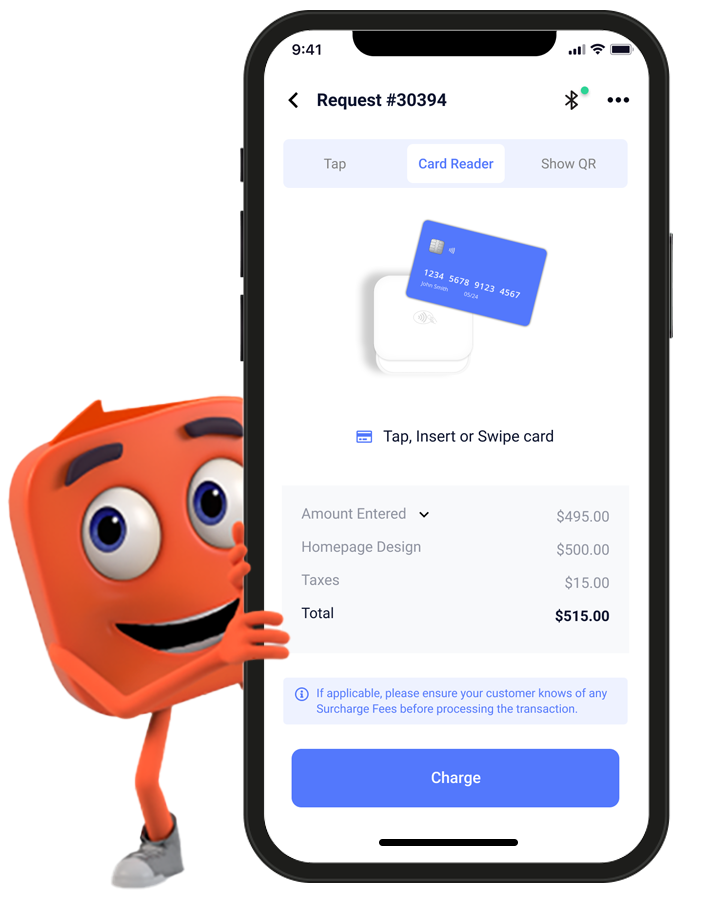

Unlock lower processing rates with ThryvPay Mobile Card Reader and Mobile Tap-to-Pay.

Our mobile card reader integrates with the ThryvPay Mobile app via Bluetooth, delivering safe and secure card-present processing with a simple swipe, insert or tap. Mobile Tap-to-Pay allows you to accept payments phone-to-phone or card-to-phone from credit cards with NFC functionality and is available on both iOS and Android.

- Mobile Card Reader and Mobile Tap-to-Pay work seamlessly together or independently.

- Enjoy the flexibility offered by our Mobile Card Reader that processes in-person or on the go.

- Save money on processing rates starting at 2.6% plus 30 cents per transaction.

- Accept payments with confidence that comes from seamless integration to our mobile app.

Book your Payment Processing Software demo now!

Generate recurring revenue with automated payments and payment reminders.

Securely store credit card and bank account information so you can process payments over and over. Schedule automatic payments and automated payment reminders as well.

- Accept daily, weekly or monthly recurring payments.

- Custom installment and payment plans.

- Develop membership programs.

- Offer financing options supported by Wisetack.

- Combine with Signatures to get all documents completed digitally.

Find out how much ThryvPay can save your business.

Calculate exactly how much money you could be saving with ThryvPay payment processing software.

ThryvPay FAQs

Your payment processing questions, We’ve got answers.

Are there benefits of offering both ACH and credit card processing?

Yes! Enjoy the benefits of both by offering your customers flexibility of payment preference. You can also determine when you want to offer your customers the option to pay via ACH or credit card, based on transaction.

What are the competitive ThryvPay processing fees?

Credit card processing rates start at 2.6% + $0.30 on all card present transactions using the mobile card reader or tap to pay, while online or keyed transactions start at 2.9% + $0.30. ACH rates are a minimum of $1.00 or 1% up to a maximum of $9.00.

How easy is it to sign up and get connected to ThryvPay?

Super easy. It only takes about 5 minutes! You’ll find an easy walkthrough guide to help with the application process. You can sign up inside Thryv during initial login with our QuickStart Wizard or go to Settings > Payments or directly from Sales > ThryvPay.

What’s included with scheduled payments?

Scheduled payments allow you to minimize late/missed payments, increase ongoing revenue, and easily manage and track revenue. Use recurring payments to charge monthly, weekly or quarterly and even installments for partial payments on large sums. Memberships allow for monthly or advanced payments generating customer loyalty.

What’s included with ThryvPay reporting?

ThryvPay transaction reporting is available directly within Thryv. The reporting tab provides detailed transaction history including the transaction amount and how it was paid, including pertinent customer information and type of transaction, such as individual, scheduled payment or refund.

What level of support is provided with ThryvPay payment processing?

ThryvPay offers a dedicated support team available via phone, email or chat to assist with payment disputes, funding/deposit questions, chargebacks and answer questions regarding your application.

Do all transactions offer next day funding?

Any transactions processed by credit card prior to 8 p.m. EST will be funded the next business day, or if completed after 8 p.m. EST transactions will be included in the next day’s total. Bank transfers will be funded within 7 business days.

What are the monthly fees associated with ThryvPay payment processing software?

None. With ThryvPay you only pay processing fees on completed transactions.

Can I offset my credit card processing fees?

Yes. ThryvPay offers the ability to charge your customers a surcharge fee that matches your processing rate on credit card transactions (available in 40 states) or you can add an optional flat dollar convenience fee amount for paying via credit card.

What is the best payment method for a small business?

Offering a variety of payment methods is better for small businesses and customers alike. Customers can pay with their preferred method, which is convenient for them and ensures you get paid faster. With ThryvPay, you can accept credit cards, ACH, and digital payments with some of the industry's most competitive payment processing rates.

How can small businesses take payments online?

ThryvPay helps small businesses accept online payments at an affordable rate. Send customers your invoice, and they can pay using a credit card or through ACH. Scroll up on this page to see our current rates for online payments.

How do I set up an online payment processing system for my small business?

With ThryvPay, it takes only 5 minutes to sign up and get started with our online payment processing system. Head to the App Store or Google Play to download and sign up for our ThryvPay App. We’ll walk you through our easy application process and our QuickStart Wizard so you can start taking digital payments from your customers.

How much does online payment processing cost?

Our online payment processing fees are some of the most affordable rates in the industry, making them perfect for small businesses. Our current rates for online payment processing start at 2.9% plus 30 cents per transaction, and our credit card processing rates start at 2.6% plus 30 cents per transaction.

How can small businesses take credit card payments?

ThryvPay payment processing software is a great, affordable way for small businesses to take credit card payments. Accept credit cards in-person or online with low payment processing rates and no hidden fees. Visit the App Store or Google Play to download and sign up for our ThryvPay App now.