Win more customers with an online payment processor for small business

Customers of small businesses today love the convenience of paying online. The days of paying with cash or check are fading fast – customers prefer to pay with digital methods like credit cards, smart phone apps and e-wallets, even when they’re purchasing goods in person or paying for services on site.

An online payment processor offers lots of benefits for small business owners as well, from streamlining invoicing to accelerating cash flow. The right online payment processor for small business can help automate processes, reduce costs and win more customers. In fact, 73% of consumers say that when comparing two businesses, the type of payment options available will influence their decision about which business to choose. 1

When it comes to selecting an online payment processor for your small business, the number of choices can be overwhelming. That’s where Thryv can help. As an end-to-end platform for small business management, Thryv offers quick and easy online payment processing with highly competitive rates and transparent pricing that takes the confusion and guesswork out of setting up online payment methods for your small business.

The benefits of online payment processing

When you operate a service-based business where you’re interacting with customers every day, setting up online payments may not seem like a huge priority. However, working with the right online payment processor for your small business can deliver some big advantages.

Simplify your invoicing

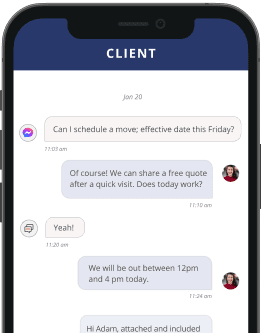

With the ability to accept online payments, you can send invoices in an email or text with a link that lets customers pay online using a credit card or mobile wallet. Many of the tasks involved in enabling online payments can be automated to reduce the time and effort required from you and your staff.

Get paid faster

When customers can pay online, it eliminates the back-and-forth of sending invoices in the mail and waiting for payments to be sent in via check. You can accelerate cash flow by allowing customers to pay online immediately after they receive your invoice in a text or email.

Reduce your costs

Offering online invoicing and payments can minimize your cost in several ways. Sending invoices via email and text eliminates the cost of paper, printing and postage for invoices sent through the mail. And you can automate so many aspects of online invoicing and payments which allows you and your staff to save a ton of time and further reduces your costs.

Learn more about your customers

When your invoicing and payment processes are digital rather than manual, it’s easy to gather a lot of data about your customers’ buying history and purchasing decisions. With this intelligence, you can make smart decisions about what kind of services to market to each customer and how to personalize their experience with your company.

Build customer satisfaction

Consumers who appreciate the convenience of online payments will be more likely to become repeat customers.

Thryv: a better online payment processor for your small business

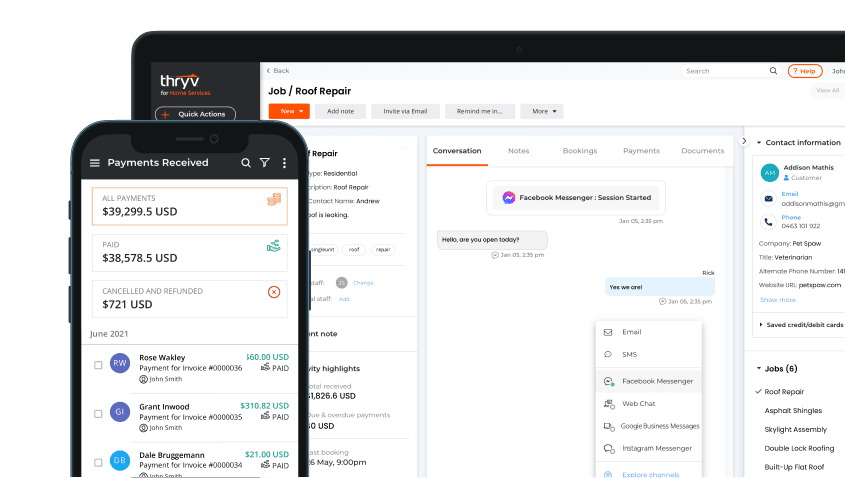

Thryv is an integrated small business management solution that delivers all the tools you need to organize your business and operate more efficiently. From automating your marketing efforts and simplifying social media to reputation management services, Thryv lets you manage virtually every aspect of your business from a single location.

As an online payment processor for small businesses, Thryv offers a variety of tools and services to help you issue invoices and accept online payments more easily.

Interactive invoices

With Thryv, you can send interactive invoices via email or text with a link that customers can use to pay online with a credit card, mobile wallet or ACH transfer.

Credit card processing

Thryv’s small business credit card processing services can swiftly process credit cards at extremely competitive rates. Unlike other small business online credit card processing services, Thryv doesn’t charge extra for phone transactions and other card-not-present transactions.

Automated payment reminders

Automated payment reminders help to ensure customers pay on time and eliminate the manual effort of making collection calls.

Flexible payment options

Thryv lets customers pay online with a variety of methods and to pay at a variety of times as well – when the appointment is booked, at the time of service, or a later date. Customers can also pay for a package of services upfront, helping to improve cashflow and encourage repeat visits.

Credit card scanning

With Thryv, you can say goodbye to plug-in card readers that may lose connection or power. Use a smart phone to scan credit cards, delivering a faster payment experience.

ThryvPay: a payment provider for service-based businesses

ThryvPay is an online payment processor for small businesses that are primarily service-based. Offering safe and secure contactless payments, ThryvPay helps you get paid how you want while giving customers the payment options they prefer.

- More payment options. Accept and process credit cards and ACH payments while enjoying next-day funding. Allow customers to pay with Apple Pay and Google Pay, triggering instant digital receipts at payment.

- Reduce costs. Eliminate fees for returned checks by moving your check acceptance online. Use ACH payments and bank account transfers to save thousands each year in processing costs.

- Get control of processing fees. Manage the cost of payment processing with flat transaction rates that eliminate guesswork and reports that let you see exactly what your fees are on every transaction. Set maximum allowable credit card limit until forced ACH. Offset the cost of fees by charging convenience fees to customers.

- Help customers finance. Financing through ThryvPay gives customers more purchasing power, with financing options that range from $500-$25,000 and terms up to 60 months. ThryvPay financing lets you get paid quickly and without risk while giving your customers more options.

Why Thryv?

Thousands of small businesses choose Thryv for the tools they need to manage operations more efficiently. From billing software for lawyers to text software for business consultants and CRM solutions for wedding planners, Thryv delivers the capabilities small business owners need to find more customers, organize the day, get paid faster and build a stellar online reputation.

As a do-it-all platform, Thryv put all the tools you need at your fingertips without needing to toggle back and forth all day between different applications and platforms. The data you enter in one application and will be immediately available in every other solution. You can access the Thryv platform from anywhere, on any device – smart phones, laptops, tablets and desktops. Unlimited, 24/7 customer service lets you get answers to your questions quickly and resolve issues fast. Cutting-edge encryption and custom access controls ensure that your data and your customers’ information is always safe and secure.