The value of small business online credit card processing

Customers today have more options than ever when it comes to shopping for goods and services – including more ways to pay than at any previous time. A recent survey reveals that customers are abandoning cash and checks in favor of digital payments like credit cards, digital wallets, bank to bank transfers and smartphone apps. They love the convenience and security these forms of payment offer, and 73% of customers say that the types of payment options available will influence where they decide to spend their money.i

This trend means that for small businesses, online credit card processing is a must. Even businesses that render services in person can find many ways to benefit from the right small business credit card processing technology.

As a do-it-all business management platform, Thryv offers small business online credit card processing solutions that can help you take advantage of customer preferences by accepting credit cards and enabling online payments.

The advantages of online credit card processing

Choosing the right online payment processor for your small business will deliver a wealth of advantages.

Improved cash flow

By letting your customers pay invoices online with a credit card or other digital payment, you can get paid immediately rather than waiting days or weeks for invoices to arrive in the mail and for customers to mail back payment.

Lower costs

With small business online credit card processing and invoicing, you’ll spend a lot less money on paper, printing and postage.

Greater convenience

Small business online credit card processing services allow customers to pay for services anytime – when booking an appointment, at the time services are rendered or at a later date. Online credit card processing also lets you set up recurring invoices that make invoicing more efficient and help you get paid sooner.

Streamlined invoicing

With small business online credit card processing, you can automatically issue invoices through an email or text rather than manually sending them through the mail. The right invoicing software for small business will let customers choose to pay with credit cards, ACH or digital wallets like Apple Pay and Google Pay.

Helpful data

When you’re invoicing and payment process is digitized, you can easily gather a wealth of data about the purchasing decisions and buying history of each customer. Analyzing this info can better illuminate what customers want and need, letting you deliver more personalized messaging and services.

Small business online credit card processing with Thryv

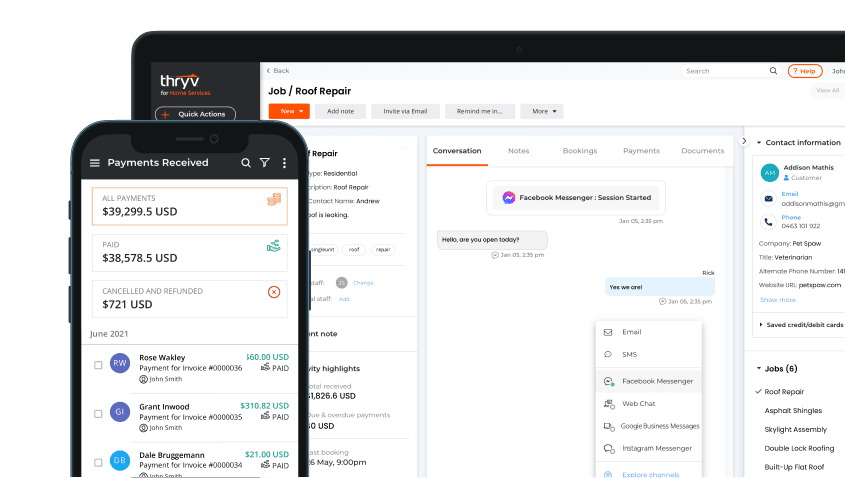

The Thryv platform provides a single solution with all the tools that small businesses need to stay organized and operate more efficiently. From marketing and social media tools to CRM solutions and online scheduling for small business, Thryv’s do-it-all platform helps to streamline all the day-to-day tasks involved in running your business.

Thryv’s small business online credit card processing solution, ThryvPay, is the only payment provider designed specifically for service-driven small businesses. ThryvPay provides customers with the convenience of submitting payments online safely and securely, while helping you get paid faster with contactless payments.

Features of Thryv’s small business online credit card processing service include:

- Highly competitive rates. Flat rates for credit card transactions and bank transfers eliminate the guesswork from predicting processing costs.

- Scheduled payments. Generate recurring revenue and minimize late or missed payments by scheduling payments in advance.

- Installment plans and memberships. Give customers more convenient options for paying, building customer loyalty.

- Payment information on file. Retaining a credit card and bank information on file in a secure catalogue provides greater convenience for customers for future payments and helps to automate billing.

- Tip options. Thryv allows customers to add a tip to the bill, enabling them to show appreciation for your service.

- Transparent fees. See exactly what your fees are on every transaction.

- Charge convenience fees. Charge clients a flat convenience fee to help offset the cost of credit card processing.

- Financing. Offer customers the option of financing their purchase through ThryvPay, in partnership with Wisetack.

- Mobile wallets. Accept payment through mobile wallets like Apple Pay, Google Pay and PayPal, allowing customers to pay quickly from their smart devices.

More solutions from Thryv

Along with small business online credit card processing, Thryv offers a broad range of other solutions for managing your business.

Marketing automation

Automatically send trigger-based marketing campaigns with personalized messages to the right customers at the right time, reducing the effort required to send out marketing emails and texts.

Social media

Create content and schedule posts from a central location, publishing to Facebook, Twitter, Instagram and LinkedIn with just a few clicks.

Scheduling

Let customers book their own appointments with online appointment scheduling. Keep your calendars for your entire team synchronized easily.

CRM

Combine all your customer data in a single location so you can find, filter, tag and track your contacts how you want. Automatically nurture leads and opportunities to win more new customers and repeat business.

Invoicing

Send interactive estimates, invoices and reminders for overdue payments. Accept payments before, during and after appointments, giving customers more ways to pay.

Communication

Manage conversations with customers from a single inbox, viewing messages in email, texts and social media in a single, client-specific thread.

Online presence

Upload and automatically sync your business information across 40+ trusted listing sites online, including Google Business Profile.

Document management

Manage documents easily and eliminate clutter with tools that let you securely request, store and share documents online. Employees and other contacts can edit documents online while Thryv tracks changes and constantly identifies the most recent version.

Reputation management

Build a stronger reputation online by automatically asking customers for reviews. Get notified immediately they post reviews and comments on major sites. Respond to reviews on Google, Yelp and Facebook within one business day, even when you’re too busy to manage it yourself.

Why Thryv?

Thryv helps small businesses compete and win. From billing software for lawyers to text marketing for small business consultants, the tools on the Thryv platform help small business owners get more business, communicate with clients, get paid faster and manage their work more easily.

Thryv’s end-to-end platform will effortlessly scale as your business grows. From a single dashboard, you can view real-time tracking and analytics to manage every aspect of your businesses more efficiently. As a cloud-based solution, you can use Thryv without purchasing or installing software and hardware. And with Quality of Support rated 9.2 out of 10 by Thryv usersii, you can rely on experienced business specialists to deliver the help you need whenever you have questions or issues to resolve.

i https://www.thryv.com/blog/thryv-payments-survey/

ii This information is accurate as of 3/16/20. As verified on G2.com.