The power of small business credit card processing

The ability to process credit cards offers lots of benefits for your small business. Customers love the convenience and tend to favor businesses that accept credit cards and other contactless payments.i Customers paying with credit cards are likely to spend more as well, since they’re not watching dollars physically leaving their wallets. Small business credit card processing reports make it easy to identify customer spending behavior, which can help you target different audience groups and upsell customers on services and products. And working with an online credit card payment processor significantly reduces the risk of theft and mishandling of cash.

The most important thing when accepting credit cards is to choose a superior online payment processor for small business. That’s where Thryv can help. As a do-it-all platform packed with productivity solutions, Thryv offers small business credit card processing with extremely competitive rates and the flexibility to get paid the way you want.

Choosing the best credit card processing merchant

You’ll have a lot of choices when selecting a small business credit card processing merchant. Here are several things to look for as you make your decision.

- The size of your business. Not all payment processors are a good fit for small business. Choosing a company with fees and features designed for the needs of small businesses is essential.

- The amount of spending. Some merchants are ideally suited for businesses with smaller average credit card purchases and certain types of transactions.

- Total amount of fees. Every credit card transaction will cost you a transaction fee, but you’ll likely also have to pay monthly account fees, early termination fees, and chargeback and retrieval fees. Be sure to look at the total of all fees over the course of a month or year when comparing merchants.

- Types of processing equipment. There are lots of ways to accept credit card payments – from swipe processors to mobile apps and devices that let customers tap their card. Choosing a merchant that offers a variety of processors will give you more flexibility. You’ll also want to make sure that your existing processors are compatible with the merchant you choose.

- Turnaround time. Payment processors vary in the time it takes for funds to move from a customer’s account into yours. Faster speeds typically come with higher fees.

- Customer service. Be sure to check reviews on customer service for any payment processors you’re considering. Choosing a company that offers 24/7 support can be helpful if you’re serving customers outside of standard business hours.

- Reputation. Be sure to research whether the merchant has experienced major data breaches, or any has complaints with the Better Business Bureau.

Small business credit card processing with Thryv

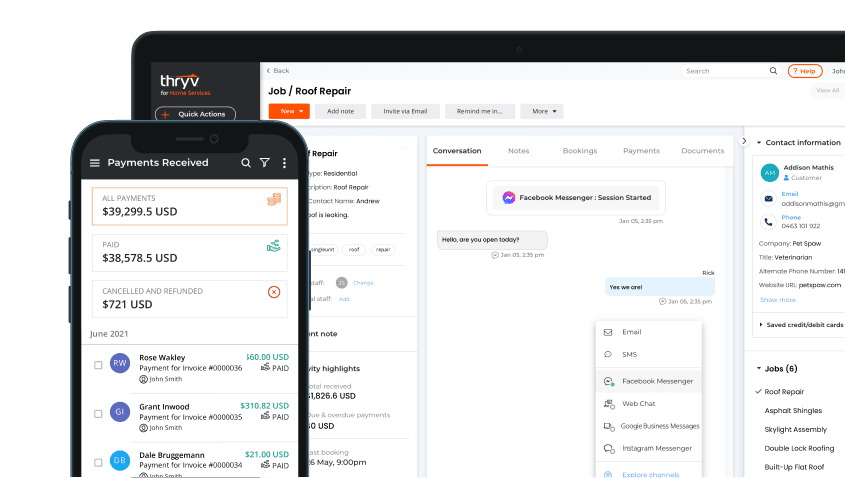

Thryv is a small business management platform that offers all the tools you need to find more customers, organize your business, work more efficiently, get paid faster and build a stronger reputation online.

Along with tools for marketing, social media, CRM, communication, reputation management and an online scheduler for small business, Thryv provides a superior small business credit card processing service with ThryvPay. Partnering with industry-leading payment processors, ThryvPay lets you easily and securely process credit cards at rates you love while giving customers more ways to pay.

Make credit card processing easy

ThryvPay lets you easily accept credit card and ACH payments with next-day funding. Additionally, Thryv offers a variety of online payment methods for small business that let customers pay the way they want, and help you get paid the way you need.

Process recurring payments

ThryvPay’s Scheduled Payments feature securely stores credit card and bank account information so you can process customer payments time and again. Set up recurring payments daily, weekly or monthly, and configure custom installment and payment plans.

Save thousands on fees with online check acceptance

ThryvPay protects your business with fraud prevention and online check acceptance. Use ACH payments and bank account transfers to save thousands each year.

Enjoy a transparent fee structure

With ThryvPay, you can control how much small business credit card processing truly costs your company. We not only offer some of the most competitive rates in the industry, but we make it easy to see exactly what your fees are on every transaction. Unlike competitors, ThryvPay does not charge a statement fee.

Charge convenience fees

Charging a flat convenience fee can help offset the cost of credit card processing while legally protecting your business and your bottom line.

Accept digital wallets

Allow customers to pay with digital wallets like Apple Pay and Google Pay, providing more convenience and added security.

Additional invoicing and payment solutions from Thryv

Along with small business online credit card processing, Thryv offers invoicing and payment solutions that help streamline work and let you get paid faster.

Online Invoicing

Thryv’s invoice software for small business lets you build quotes and estimates fast, issue invoices from the field, and allow clients to approve them on their mobile devices. Online invoicing allows you to get paid as soon as the job is done and makes it easy to track the status of each invoice.

Accept payments anytime

Take payment at any stage of the customer relationship, including payment at time of booking to accelerate cash flow.

Automated payment reminders

Thryv can automatically remind customers to submit payments, simplifying collections and helping you get paid more regularly.

Accept payment on packages of services

Selling packages of services encourages repeat business. Thryv can help you track payments and help customers track their use of services they purchased.

Scan credit cards any way you want

Thryv makes it easy to scan credit cards with or without a card reader. Instantly scan cards on your smart phone for a quick and convenient payment experience.

Why Thryv?

Thryv offers the ultimate collection of software for small business productivity. Trusted by tens of thousands of business owners, Thryv delivers all the solutions you need to manage your workday more efficiently and keep your business organized.

- One login and one dashboard. As an end-to-end platform, Thryv lets you access all the tools you need without logging into multiple applications or toggling between different browser windows all day long.

- Access from anywhere. Use Thryv’s software from any place and on any device – desktop, laptop, tablet or mobile phone. With Thryv, the tools you need are always at your fingertips.

- Unlimited 24/7 support. Thryv is the only small business software platform that offers unlimited support from customer service specialists who have both business know-how and technical expertise. With Thryv experts standing by 24/7, you can get the help you need any time of day, no matter where you are.

- Seamless integration. Thryv integrates easily with the business tools and solutions you already know and use like QuickBooks, WordPress, PayPal, Zoom, Gmail and many more.

- Strong data security. With cutting-edge encryption technology and customizable account access, your documents and your customer data are always safe and secure.