Even before COVID-19 hit, there was a surge of nearly 14% in non-cash transactions.

With a continuous push toward contactless payments coupled with cards offering the convenience of not digging around for exact change, consumers would rather pull out their plastic.

As more people swipe away, businesses may take notice of the fees adding up. Small business owners may start thinking about how to offset credit card processing fees. This is why many charge a convenience fee for credit card processing.

80% of consumers prefer card payments over cash.

Are you wondering if passing on credit card fees to customers is a good idea for your business? Or if you’re even legally able to charge them?

Are you a business on the fence about making the jump to accept anything other than cash and checks?

We’ve got you covered on the basics of credit card convenience fees.

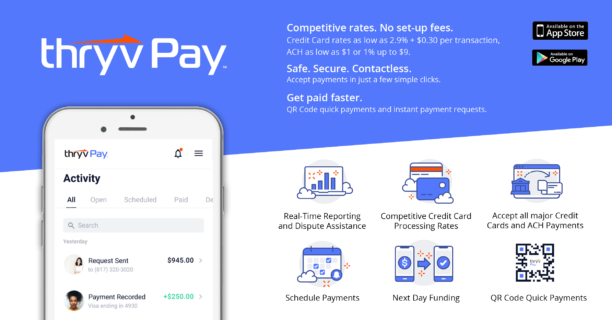

Save on online payment processing fees with ThryvPay

DownloadWhat Are Credit Card Convenience Fees?

In short, convenience fees are a small flat-rate or percentage fee charged to customers making a credit or debit card purchase, rather than a payment process that’s standard to the business.

Sometimes they can feel like a bother for customers but, the truth is, they’re there for a reason.

Credit card processors charge businesses a fee on each credit card transaction.

Adding convenience fees is a way to offset some of those costs. Business owners can avoid charging customers individual transaction fees by building the cost into their product or service prices.

The Quickstart Guide

to Digital Payments

All you need to know about small business payment processing.

But First, Read the Fine Print

Often, convenience fees are confused with surcharges. What’s the difference? Surcharges charge the customers just for using a credit card and it’s often a percentage rather than a flat rate — and they’re illegal in at least 6 states.

Convenience fees are guided by card network rules, while surcharges are regulated by state laws.

Here’s the twist: If you decide to charge convenience fees, you must offer multiple ways for your customers to pay. So what they’re paying for is the convenience of using their credit card.

Some small businesses choose not to accept credit cards at all to avoid the fees, especially since some processing networks tend to charge higher rates.

Unfortunately, this means they’ll lose out on business when customers don’t have cash on hand.

Stay in the know on convenience fees based on the card network’s rules.

- American Express allows convenience fees as long as they occur on similar transactions. Customers must be informed of the fee before purchase and also be given the option to cancel the transaction.

- Mastercard allows convenience fees but the business must place the fee on all other similar transactions. It doesn’t matter which payment method is used.

- Visa allows convenience fees for payments taking place on an alternative payment channel. The customer must be informed of the fee before purchase and the business must charge a flat rate rather than a percentage.

Which Does ThryvPay Use?

ThryvPay offers a convenience fee that’s applied only to credit cards, debit cards and e-commerce transactions in the client portal checkout— not ACH.

Unlike surcharge percentages, flat convenience fees legally protect your business while effortlessly counteracting your competitive processing cost, which saves your bottom line.

The competitive processing fees are another great added benefit of using ThryvPay.

With credit card processing rates starting at 2.9% + $0.30 per transaction and ACH rates at a minimum of $1 or 1% up to a maximum of $9, ThryvPay is an answered prayer for small business owners, especially those who invoice high-priced services.

Debit cards account for 67% of card payments.

When Shouldn’t You Charge a Convenience Fee?

That is totally up to you. If you’d like to do individual transaction fees, do it. If you’d like to take on those added costs yourself, you’re welcome to run your business as you see fit.

Offering a discount for cash purchases may encourage customers to stop by an ATM before swinging by to support your business.

Keep in mind, the average cash transaction is $22 while the average non-cash transaction is $112. You might also consider waiving fees for those who join your rewards club or membership.

With debit and credit cards being easily accessible and preferred by consumers, business owners can’t afford to not modernize and accept plastic as payment.

By knowing what you’ll pay per card transaction, you’re able to price products accordingly to protect your bottom line.