How to manage credit card processing for small business

Accepting credit card payments is an absolute must for small businesses today. Studies show that customers highly preferred debit and credit cards when it comes to paying for services1 and that nearly 75% of consumers say the type of payment options available will influence their final decision about where to shop.

For small business owners, however, choosing the right credit card processing company can be a challenge. The overwhelming number of choices and the many types of fee arrangements make it difficult to know which payment processing merchant offers the most advantageous credit card processing for small business.

That’s where Thryv can help. As an end-to-end solution for small business management, Thryv offers quick and easy small business online credit card processing with the ability to swiftly process credit cards at extremely competitive rates.

Choosing the right credit card processing service

When implementing credit card processing for your small business, here are a few criteria to keep in mind as you evaluate your options.

- Size of your business. Some credit card processors structure their payment processing terms and fees in ways that work well for small businesses, but others are geared for larger companies. The volume of transactions and the average size of payment will affect which processor works best for you.

- Fees. In addition to transaction rates, you’ll need to consider commonly hidden fees like monthly account fees, early termination fees, and chargeback and retrieval fees. Taking all fees into account is the only way to compare apples to apples when choosing a payment processor.

- Flexibility. The best merchants for credit card processing for small business will offer a variety of ways to accept card payments, from point-of-sale terminals and online portals to mobile apps that let you scan credit cards with your phone.

- 24/7 support. When a payment isn’t processing or your equipment isn’t working, you need assistance ASAP. Choosing a company that offers 24/7 customer service is essential.

- Reputation. Your credit card merchant should have a positive rating with the Better Business Bureau, stellar online reviews, and no major data breaches.

Small business credit card processing with Thryv

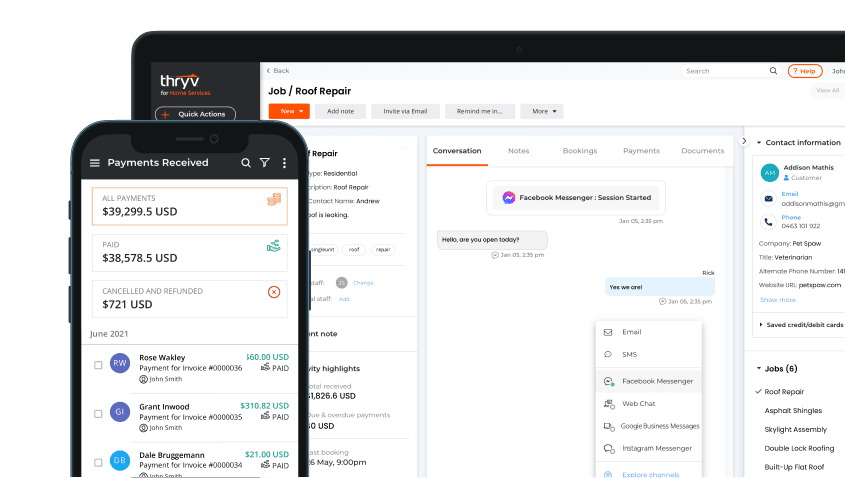

Thryv’s small business management platform delivers all the tools you need to run your business from one place. From solutions for marketing and social media to online scheduling and text marketing for small business, Thryv’s solutions can help you stay organized, automate processes and increase efficiency.

ThryvPay, our online payment processor, offers easy and secure credit card processing for small business at rates you will love. You’ll have the option of storing credit card info for future recurring payments, offering customers more convenience. And unlike other processors, Thryv doesn’t charge extra for phone transactions and other transactions where the card is not present.

With ThryvPay for credit card processing for small business, you can:

- Easily accept credit card payments.

- Accept ACH payments and bank account transfers to save thousands a year in fees.

- Automatically charge convenience fees to customers to offset the cost of credit card processing for your small business.

- Make it easy for customers to leave a tip.

- Get next day funding.

- Offer installment plans and recurrent payments.

- Allow customers to schedule payments in advance.

- Integrate with QuickBooks.

ThryvPay offers some of the most competitive rates in the industry, along with transparent terms that let you see what your fees are for every transaction.

Give customers more purchasing power with financing through ThryvPay

Along with credit card processing for small business, ThryvPay offers financing options that range from $500-$25,000, available in terms from 3 to 60 months. Powered through a partnership with financing leader Wisetack, this additional payment method allows customers to prequalify for financing early in the buying process. Customers can use ThryvPay financing for things like home services and repairs, auto maintenance, or medical, dental or veterinarian services.

Financing through ThryvPay gives customers more flexibility and more time to pay. For your business, financing improves cash flow, since you’ll get paid as soon as the work is done. Wisetack settles with the customer over time and handles any late or defaulted payments. And you can leverage the financing options through ThryvPay to upsell customers on services, potentially increasing your revenue by 20+ percent.

Thryv also offers a variety of additional invoicing and payment solutions, including interactive estimates, automated payment reminders, and invoicing software for small business.

Why choose Thryv?

Thryv provides business management software that can be tailored to the needs of a broad array of small businesses. Whether you’re looking for social media tools for your veterinary clinic, billing software for attorneys, CRM solutions for your construction business or online file storage for your small business, you’ll find all the tools you need on the Thryv platform.

Our software has helped small businesses increase the average number of customers by 25%, and the number of appointments booked by 61%. Thryv customers have also seen an average annual revenue increase of 86% through bookings and payments.2

1 Thryv/Payments Dive 2022 Consumer Payments Survey

2 Statistics based on average Thryv usage data over a 12-month period.