You’re accepting payments by card, tap, online and by phone, but what happens when a customer disputes a charge and you need to send money back?

Digital payments have become an essential part of your operations. However, when a dispute or demand for a refund arises, it’s crucial to know how to handle it.

Here are six easy steps you can take to ensure you prepare for and manage digital payment disputes effectively.

Free: Quickstart Guide to Digital Payments

DownloadWhat Are Payment Disputes?

Payment disputes, at their core, are disagreements between a business and a customer about payment. They occur for a variety of reasons, ranging from simple misunderstandings to more complex issues such as fraud or breach of contract.

Common reasons customers dispute payments include:

- Billing errors. This can include incorrect charges, duplicate charges, or charges for services not rendered. These types of disputes can often be resolved quickly by reviewing the invoice and making any necessary adjustments yourself.

- Quality of services. In some cases, the customer may feel that the service did not meet their expectations. In these situations, it is important to have clear communication and a contract that outlines the terms of the agreement.

- Issues with payment processing. This can include unnotified late payment charges, unauthorized purchases, duplicate payments or subscription errors.

Regardless of the cause, payment disputes can be a headache for both parties involved. This is why getting ahead is key.

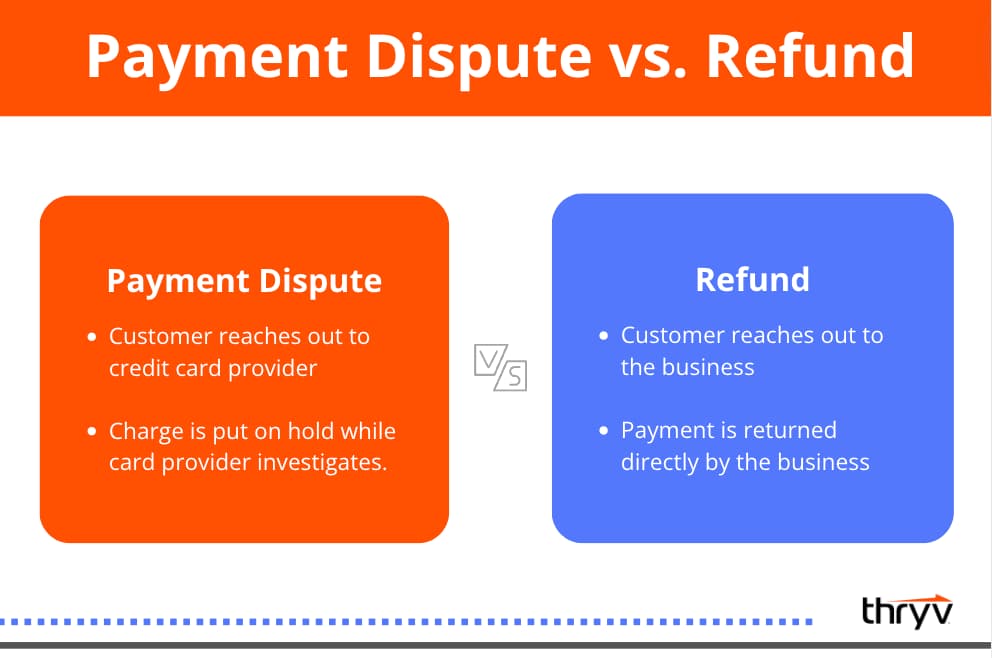

Payment Disputes vs. Refunds

Payment disputes and refunds both relate to issues with payments, there are important differences between the two.

A payment dispute occurs when a customer initiates a return for a charge on their credit card to their bank or credit card company. The payment may be temporarily withheld while the issue is investigated.

On the other hand, a refund is when a buyer requests a return of their payment from the business directly. Refunds are typically initiated by the business, and the payment is returned to the buyer’s original payment method.

Now that we’ve covered the basics, let’s talk about how to deal with payment disputes.

How to Deal With Payment Disputes

Here are six effective ways to deal with payment disputes before and after they occur.

Preventing Payment Disputes

You can’t predict the future, but you can be ready for anything. Payment disputes or chargebacks often cost your business more than the original transaction. Hello, associated fees.

This is why it’s important to build a relationship with your clients, so they come to you before calling their banks. Encourage customers to reach out by phone, email or even your social media so your business can rectify any issues that arise.

In addition to simplifying communication, there are best practices that will decrease the number of digital payment disputes your business faces.

The Quickstart Guide

to Digital Payments

Find everything you need to know about collecting payments, processing payments, late payments, and more in this free resource.

1. Have Clear Payment Policies

What are your policies? Having clear payment policies is crucial to avoid payment disputes.

Make sure you communicate your payment policies to your customers in writing, both online and in-store.

Your policies should include these basics at a minimum:

- Payment methods accepted

- Service process timelines

- Refund policy

Be sure receipts are always itemized to reduce confusion, and if your business allows payment plans, make sure to list those details as well.

While reminders before the recurring charges are helpful, including those details on the original paperwork will help save your tail if their bank comes to question you.

If you like the idea of providing notice, but not the responsibility of keeping up with client payment schedules, invest in a CRM that offers automated marketing.

Schedule emails to send to customers the week before payment is due. They’ll get the update and your business will look even more trustworthy and caring, all while creating another layer of protection.

2. Follow Credit Card Guidelines

Staying compliant with credit card guidelines will also help reduce the number of payment disputes your business receives. Using a reliable point-of-sale system and payment gateway will help protect you and your customers.

Unauthorized transactions are a leading reason for chargebacks.

Combat this issues regarding fraudulent purchases by:

- Requiring the cardholder’s ID and signature on swipe-only cards

- Have customers use their pin on debit card transactions

- Train employees properly and use the fraud prevention tools offered by your payment processor.

3. Keep Detailed Records

The devil is in the details, and it’s better to have too much information than not enough.

“To be in the best position to handle a dispute, it’s important to have all documentation pertaining to the purchase on file and ready to go,” says Fiona Allen, ThryvPay Product Relationship Manager.

Keeping detailed records of all transactions is essential, especially when it comes to payments. Ensure that you save all payment confirmations, invoices and receipts. These records will come in handy when resolving payment disputes.

Be armed with the most up-to-date and accurate documentation regarding the purchasing and delivery process.

—Fiona Allen

Dealing With Payment Disputes

Regardless of how proactive you are, your business is likely to still face chargebacks. And when it’s time, you’ll be best prepared if you follow these next steps.

4. Respond Promptly

Once you receive a payment dispute, you’re officially on the clock. Delaying your response could escalate the situation, and your customer may decide to take legal action.

Responding quickly shows that you take payment disputes seriously and are willing to resolve the issue.

5. Investigate the Dispute

We know they say the customer is always right — but for the sake of your business, investigate. Review your payment policies, transaction history and any communication you had with the customer.

Contact the payment processor or bank to gather more information about the transaction, if necessary.

When disputes do occur, you’ll be working closely with your payment processor. Because of this, you’ll want to be sure you’ve vetted the company and can have full confidence in the service they provide.

That’s why so many people put their trust in payment processing software. On all disputes and chargebacks, users receive a notification with information regarding the chargeback, such as the total amount and date of the dispute.

Pro Tip: Payment processors aren’t just great for organization. They can help you earn more, too. Check out how in the video below.

6. Communicate with the Customer

Communication is essential when resolving payment disputes, especially when the client feels service fell short. Unresolved customer complaints are a valid use of the chargeback process but those chargebacks cost you big time.

Reach out to the customer and listen to their concerns. Try to understand their perspective and find a solution that works for both parties. If you can get them to give your business another shot to make things right, that’s even better!

If that fails, offering a refund or partial refund is an excellent way to resolve payment disputes if the customer is unhappy with a product or service.

Regardless, ensure that you have a clear refund policy in place and follow it consistently.

Payment disputes can be challenging, but handling them effectively will help your small business on the road to success. By using these quick tips, you can manage refund requests and payment disputes all while maintaining positive customer relationships.

The Quickstart Guide

to Digital Payments

Find everything you need to know about collecting payments, processing payments, late payments, and more in this free resource.