-

- Products

MARKETING

Build your brand and manage your marketing with less effort.

- Enhanced Local Listings

- Reputation Management

- Social Media Management

- Website Builder

SALES

Everything you need to streamline your day-to-day business.

- Scheduling & Appointments

- CRM

- Invoices

- Pipeline Management

AUTOMATION

See communication from multiple channels in a single easy-to-use inbox.

- Marketing Automation

- Automated Reviews

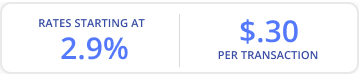

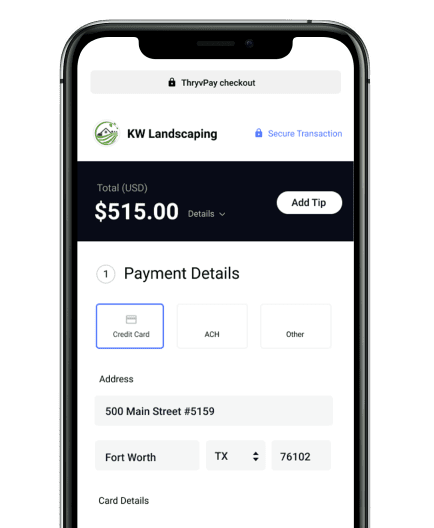

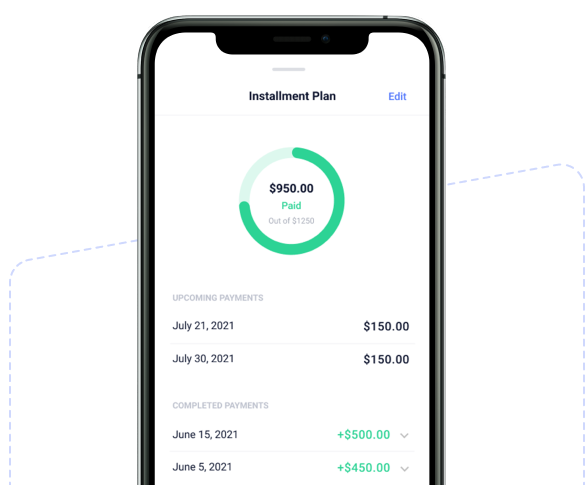

- Automated Payments

- AI Powered Solutions

ADD-ONS

Need a little something extra? Find it here.

- SEO Management

- Thryv Leads

- Growth Package

- Workforce Center

- Pricing

- Industries

FEATURED INDUSTRIES

- Pet Services

- Auto Services

- Cleaning Services

- Insurance Services

- Child Care Services

HOME SERVICES

- Roofers

- HVAC

- Plumbers

- Landscapers

- Home Improvement

HEALTH & WELLNESS

- Med Spa

- Medical Practice

- Dental Practice

- Chiropractic

- Fitness Studio

LEGAL SERVICES

- Bankruptcy Law

- Civil Law

- Criminal Law

- Family Law

- General Law

- Resources

RESOURCES

- Free Tools

- Reviews & Testimonials

- Compare

- Events

- Webinars

BLOGS & CONTENT

- Blog

- Small Business Guides

- Podcasts

- How to Videos

- Why Thryv

- Partners

- Products