The future of small business payment processing

When you’re running a small business, payment processing trends may not really be on your radar. Your days are likely filled with hundreds of other pressing tasks related to serving customers and getting work done. But small business payment processing options are quickly evolving and can make a big difference in keeping customers satisfied – and getting paid faster.

Customers today prefer online payment processing, even when they’re shopping in store or engaging your services in person. Online processing enables contactless payment – a big deal during the pandemic – and gives customers more ways to pay. For businesses, online payment processing offers a wealth of benefits like accelerating cash flow, simplifying invoicing and reducing costs.

As a do-it-all platform with management software for small business, Thryv offers multiple small business payment processing technologies to help you navigate online payments more easily. With Thryv, you can get paid the way you need to while letting your customers pay the way they want.

Give customers the payment options they demand

A recent surveyi revealed some fascinating facts about customer preferences when it comes to payments.

- Overwhelmingly, consumers prefer to use digital wallets, touchless or contactless terminals, tap-to-pay platforms, smart phone apps and other online payment methods when making payments to service-based businesses.

- 73% of consumers report that the type of payment options available will influence their decision about which company to do business with.

- 77% of consumers said they believe using a credit card on an online portal is just as safe or safer than paying in person.

- 66% of consumers are likely to pay with an ACH or bank-to-bank transfer rather than a credit card, if that option is available.

- 71% of consumers intend to continue using cashless payments in the future.

There are several reasons likely for this monumental shift in consumer payment preferences. Online payments are far more convenient, allowing customers to simply tap their card or phone on a machine to complete a transaction. Online payments let customers pay quickly in a matter of seconds rather going through the hassle of dropping a check in the mail.

Online payments also deliver lots of benefits for small business payment processing. When you offer online payments, you can invoice clients immediately via email and text and often get paid just as fast. Accepting payments online makes it easier to track customer data, using that information to personalize and enhance the customer experience. And online payments let you accept payments earlier in the process like when customers book appointments or the minute a job is finished, helping to accelerate cash flow.

Small business payment processing with Thryv

Thryv offers end-to-end solutions that help small businesses stay organized and operate more efficiently. From marketing automation solutions to client management software for small business, Thryv puts all the tools you need to find customers, manage workloads, generate cash flow and build a stellar online reputation at your fingertips.

Thryv offers several options for small business payment processing.

ThryvPay

ThryvPay is a small business payment processing solution designed specifically for service-driven businesses. With ThryvPay, you can easily accept credit card and ACH payments and enjoy next-day funding. Scheduled Payments feature securely stores account information so you can process recurring payments, schedule future payments, set up installment plans or implement membership programs to enhance cash flow. Thryv’s ACH options move your check acceptance online, so you’ll never have to deal with returned checks again. With customizable settings that let you charge convenience fees or that set maximum allowable credit card limits, you can easily control how much payment processing really costs your business.

Credit card processing

Thryv partners with industry-leading payment processors to make online credit card processing easy and secure at highly affordable and competitive rates. Unlike other payment processors, Thryv’s online credit card software doesn’t charge extra for phone transactions or transactions where the card isn’t present.

Online invoicing

Thryv’s invoice software makes it easy to quickly produce invoices and get paid online as soon a job is done. Automatic reminders help minimize late payments and keep cash flowing in.

Packages of services

With Thryv, you can encourage customers to purchase packages of services in advance, making life easier for them while accelerating your cash flow.

Smartphone credit card scanning

Rather than relying on plug-in devices and card readers that frequently lose connection and power, Thryv lets you scan credit cards instantly on your smart phone to process payments faster and from anywhere.

Additional small business management solutions

Along with small business payment processing, Thryv provides comprehensive solutions that simplify nearly every aspect of managing a small business.

Managing customer relationships

Consolidate all your contact lists into a powerful CRM that helps you nurture relationships with leads and customers.

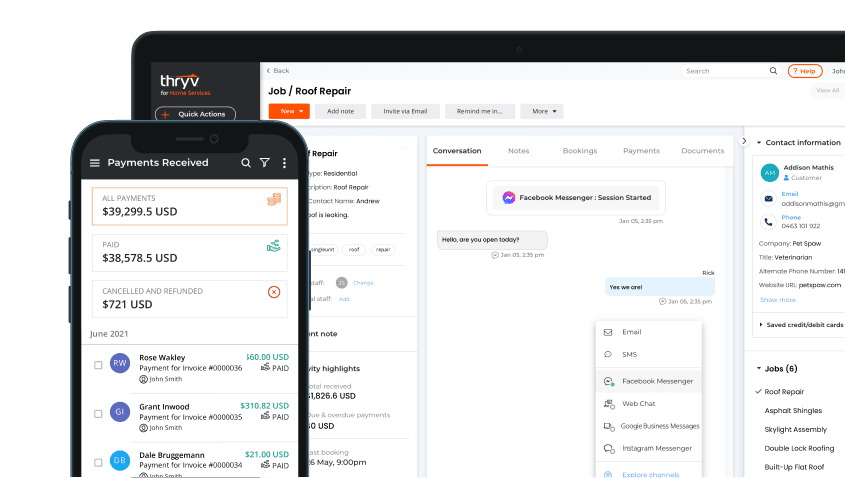

Streamline communications

Communicate with customers on their channels of choice – via text, social and email – all from a single inbox.

Make appointment booking convenient

Let customers book appointments online, any time of the day or night. Keep your calendars synced and eliminate no-shows with automated reminders.

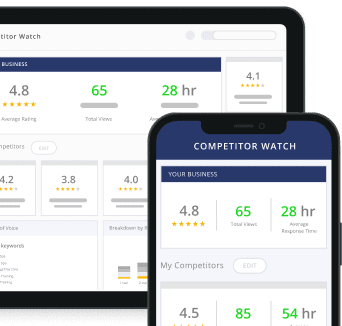

Manage your online reputation

Take control of and protect your reputation online. Generate first-party reviews and respond to comments within one business day automatically, even when you’re too busy to handle it yourself.

Automate marketing campaigns

Automatically trigger targeted marketing campaigns and one-off announcements to improve customer relationships and never forget to follow up with contacts again.

Build your online presence

Sync your business info across 40+ listings sites, including Google Business Profile. Give customers an interactive client portal and get a fast, modern, mobile-ready website.

Store and share documents online

Eliminate paper clutter with tools to securely request, store and share documents directly with your contacts.

Simplify social media

Create content in a centralized place and publish to your Facebook, Twitter, Instagram and LinkedIn accounts with just a few clicks. Schedule posts in advance when you’re too busy to manage social media throughout the day.

Why choose Thryv?

Thryv provides small business owners with all the tools they need to manage and grow their businesses. As a do-it-all platform, Thryv eliminates the need to move between different applications all day long, repeatedly logging in to the same platforms over and over. Thryv can be accessed from anywhere, at any time, on any internet-connected device – mobile phone, tablet, laptop or desktop.

Thryv integrates easily with the productivity tools that small business users already rely on: QuickBooks, PayPal, Gmail, Zoom and others. Thryv also offers unmatched, unlimited support 24/7 that puts users in touch with Thryv specialists who have both technical expertise and business know-how.

In addition to a wealth of solutions, Thryv offers a variety of free tools where small business users can learn how to generate an invoice effectively, generate links for reviews, assess email marketing effectiveness and more.