Get paid faster with online payment processing

Customer payment preferences are rapidly changing, which means the way your small business processes payments must change as well. In service-based businesses especially, customers are overwhelmingly moving away from cash and checks, choosing to pay for services with digital wallets, bank-to-bank transfers, smartphone apps and other digital methods.

Adopting online payment processing technology will let you take advantage of this trend. Even when most of your business is conducted in person or on site, online payment processing gives customers more ways to pay and simplifies the way your business accepts payment.

As a do-it-all platform for business management software, Thryv offers multiple options for online invoicing and payment processing to help you get paid faster than ever before.

The benefits of online payment processing

Choosing to accept payments online offers lots of advantages for your small business.

Easier invoicing

Online payment processing enables you to send digital invoices, rather than manually preparing invoices and sending them through the mail. With online invoicing, you can use invoice software that automates many of the tasks involved in preparing invoices, sending invoices to customers via a link in an email or text. The link allows customers to view and pay their invoices online, choosing from credit or debit cards, ACH or e-wallets like PayPal or Apple Pay.

Better cash flow

Digital invoicing combined with online payment processing can accelerate payment by days or weeks. Invoices sent via email or text arrive immediately, and customers have the option of paying immediately as well.

More convenience

With online payment processing, your customers can pay for goods and services anytime they want – when they book an appointment online, at the actual point of sale, or at a later date. Online payment processing is more convenient for businesses as well, as it’s easier to set up recurring invoices and to allow customers to pay for packages of services.

Less cost

Sending invoices and accepting payments online reduces the cost of printing, paper and postage. Much of the processes involved in online invoicing and payment can be automated, reducing labor costs.

More data

By digitizing the invoicing and payment process, companies can gather much richer data about customers and their purchasing and history. Analyzing payment data allows businesses to predict customer behavior and deliver a better, more personalized customer experience.

Online payment processing with Thryv

Thryv offers end-to-end solutions that help business owners stay organized and work more efficiently. From automating marketing campaigns and streamlining social media to nurturing customers with customer relationship management software, Thryv delivers tools to simplify nearly every aspect of your small business.

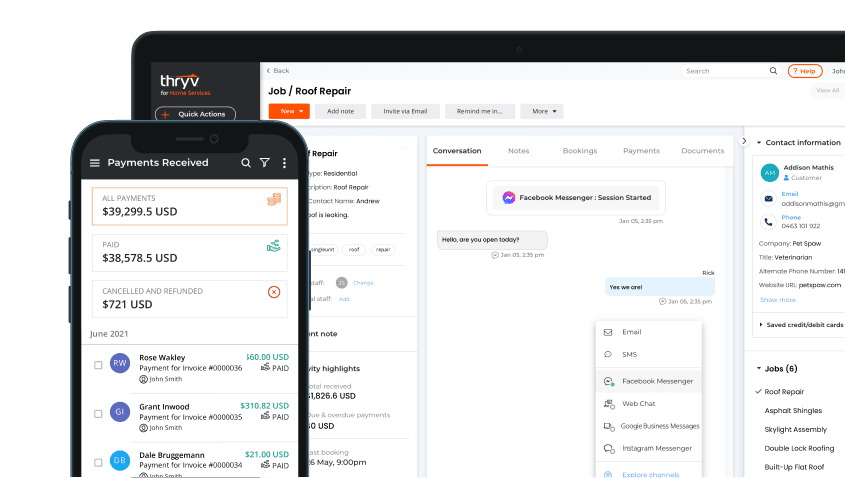

Thryv offers multiple small business payment processing solutions that simplify the payment process and help you get paid faster.

Credit card processing

Thryv makes online credit card processing easy and secure, at highly competitive rates. Partnering with industry-leading payment processors, we give you more ways to get paid – from Apple Pay, Google Pay and PayPal to credit cards, debit cards and ACH. Thryv gives small businesses the ability to store customer credit card info for future or recurring payments, and lets you track how much money you have coming in and out. Unlike other payment processors, Thryv’s online credit card software doesn’t charge extra for phone transactions or other card-not-present transactions.

Online invoicing

Thryv’s online invoicing software lets you get paid online as soon as a job is done. Tracking overdue payments is simple, and you can automatically follow-up on late payments to keep cash flowing. Thryv can also show you how to generate an invoice that increases engagement with customers rather than simply documenting a transaction.

Accept payments anytime

Thryv delivers greater convenience for customers and cash flow advantages for you by making it simple to accept payments at any stage of the customer relationship, including accepting payment when booking appointments or when paying for a package of services in advance.

Skip the card reader

Instantly scan credit cards with a smart phone to accept payments on the go or from the field. Eliminate the plug-in card readers that frequently lose connection and power.

ThryvPay: online payment processing for service-driven businesses

ThryvPay is an online payment processing solution designed specifically for service-driven small businesses. Offering contactless payments, Thryv helps you get paid faster while processing payments safely and securely.

Convenient payment options

With ThryvPay, you can accept and process credit cards and ACH payments and even enjoy next-day funding.

Save thousands

Eliminate returned checks and associated fees by moving your check acceptance online. Use ACH payments and bank account transfers to save thousands each year in processing costs.

Control fees

Take control of the cost of payment processing with reports that let you see exactly what your fees are on every transaction. Set maximum allowable credit card limit until forced ACH. Offset the cost of credit card processing with convenience fees charged to customers.

Offer financing

ThryvPay financing gives your customers more purchasing power, with financing options that range from $500-$25,000 over terms up to 60 months. ThryvPay Financing lets you get paid quickly and without risk while giving your customers more ways to pay.

Accept digital wallets

Allow customers to pay from their smart devices by accepting Apple Pay and Google Pay, triggering instant digital receipts at payment.

Why Thryv?

As a do-it-all platform for small business management, Thryv is trusted by over 100,000 business owners to deliver the tools they need to run their business more efficiently. Thryv’s end-to-end solutions enable business users to avoid the hassle of moving between different platforms and applications all day long, repeatedly logging in to the same tools while copying and pasting data between different platforms.

Thryv’s solutions can be accessed on any device – mobile phones, laptops, tablets and desktops. Thryv integrates easily with common business and productivity tools like QuickBooks, WordPress, PayPal, Zoom and Gmail, allowing users to keep using the technology they are familiar with while adding solutions from Thryv to their workflow.

Cutting-edge data encryption and customized access controls help keep data safe and secure, ensuring that only authorized users can access business files and customer information. Unlimited support gives small business owners 24/7 access to Thryv specialists with expertise in both small business management and technical know-how.