Thryv and America’s Small Business Development Centers (SBDC) have conducted an ongoing joint study over the past several months in multiple waves to understand exactly how deeply the coronavirus (COVID-19) has impacted small businesses.

As the devastation from the virus swept the nation, we committed to updating the study regularly. Week-over-week data has revealed trends in demand for small businesses as well as future implications for their financial stability. We recently concluded the study with the 16th wave, which is highlighted below. =

16th Wave: Second Outbreak Concern Grows

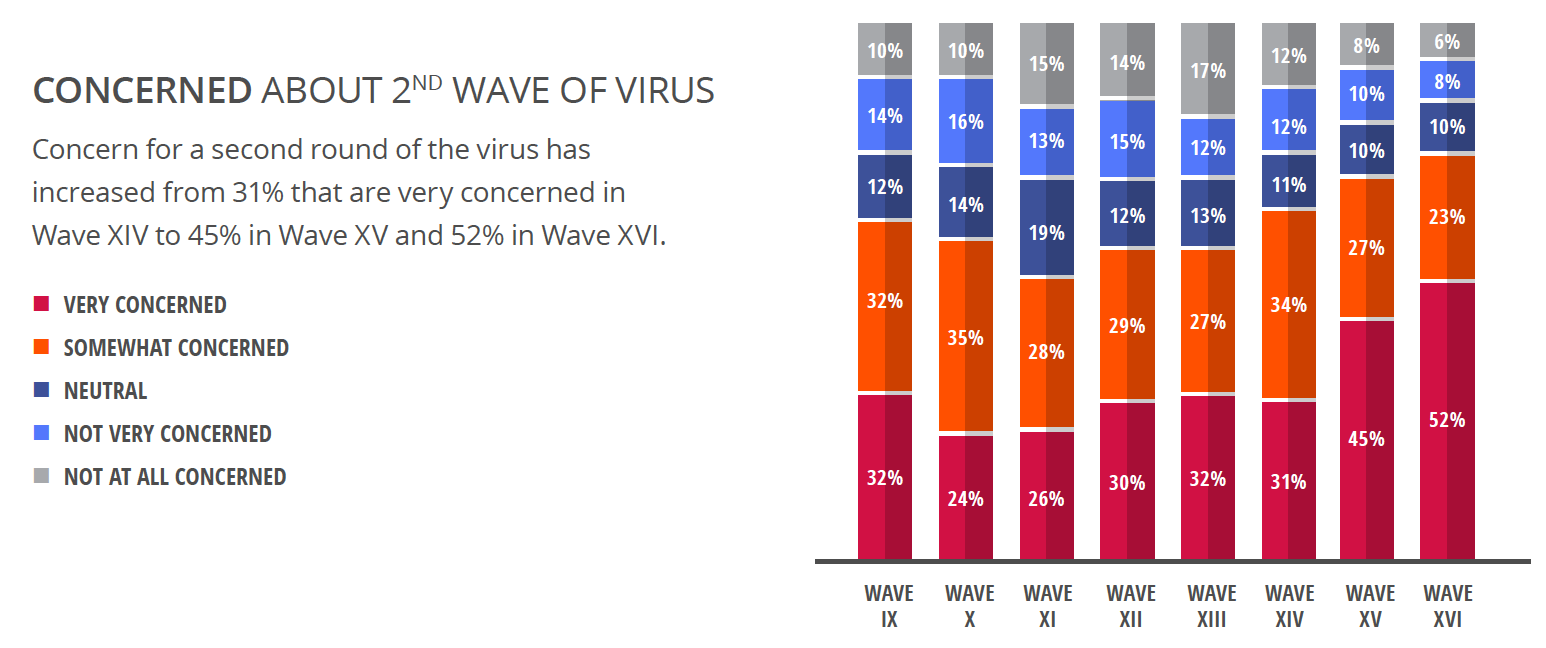

The 16th and final wave of the study has been completed, occurring July 2 – 6. As concern is growing that a second outbreak will impact businesses, some have begun to rethink reopening.

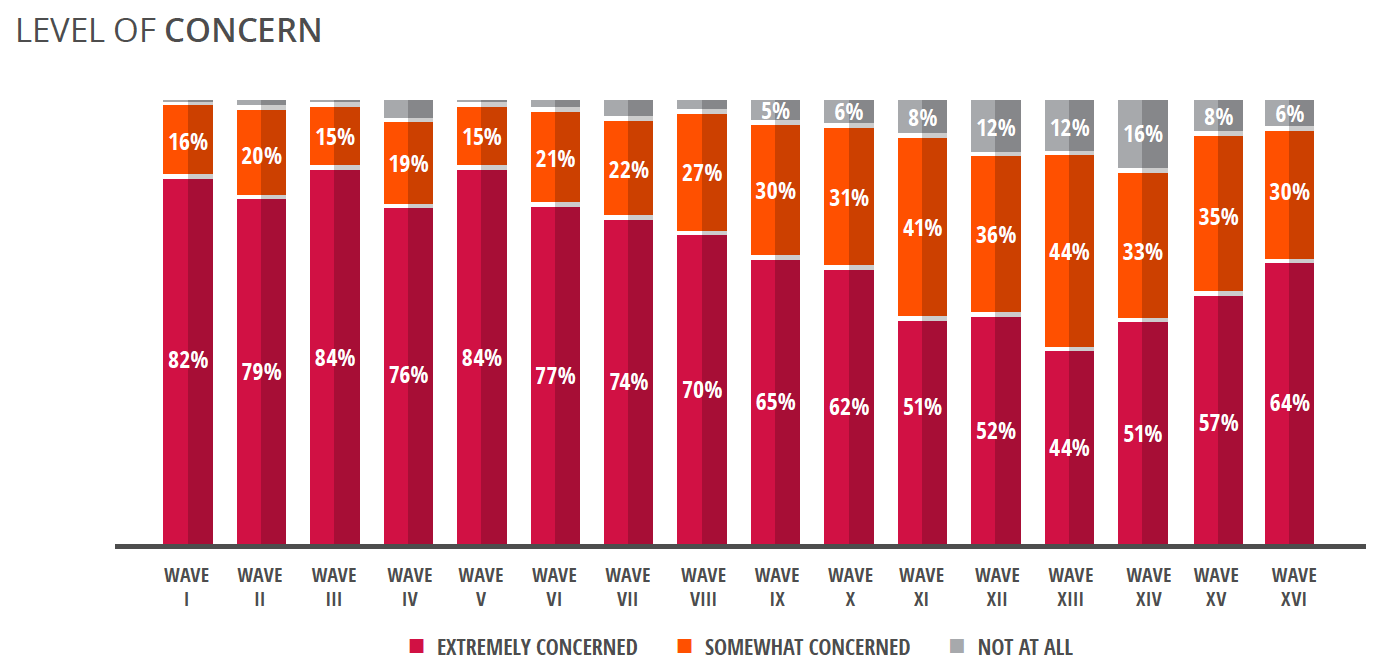

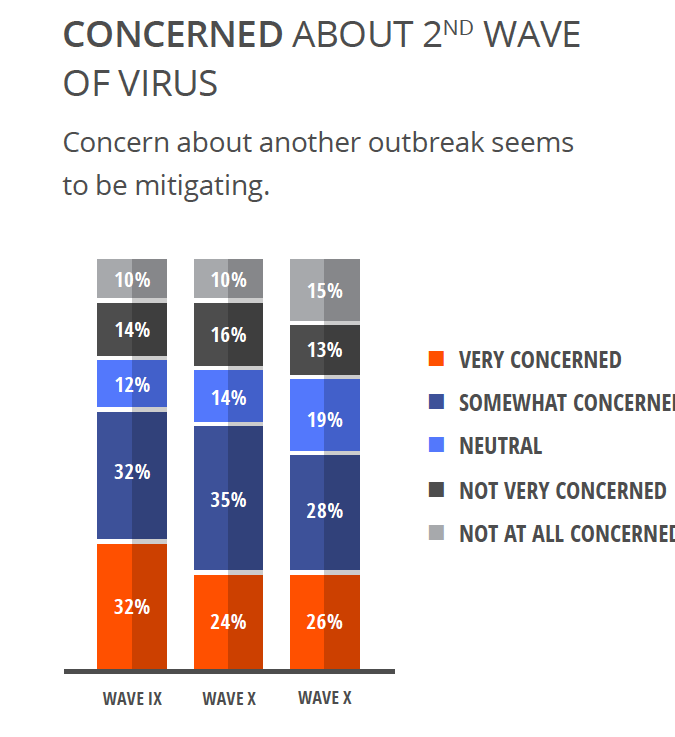

- 75% of respondents expressed some level of concern about a second outbreak.

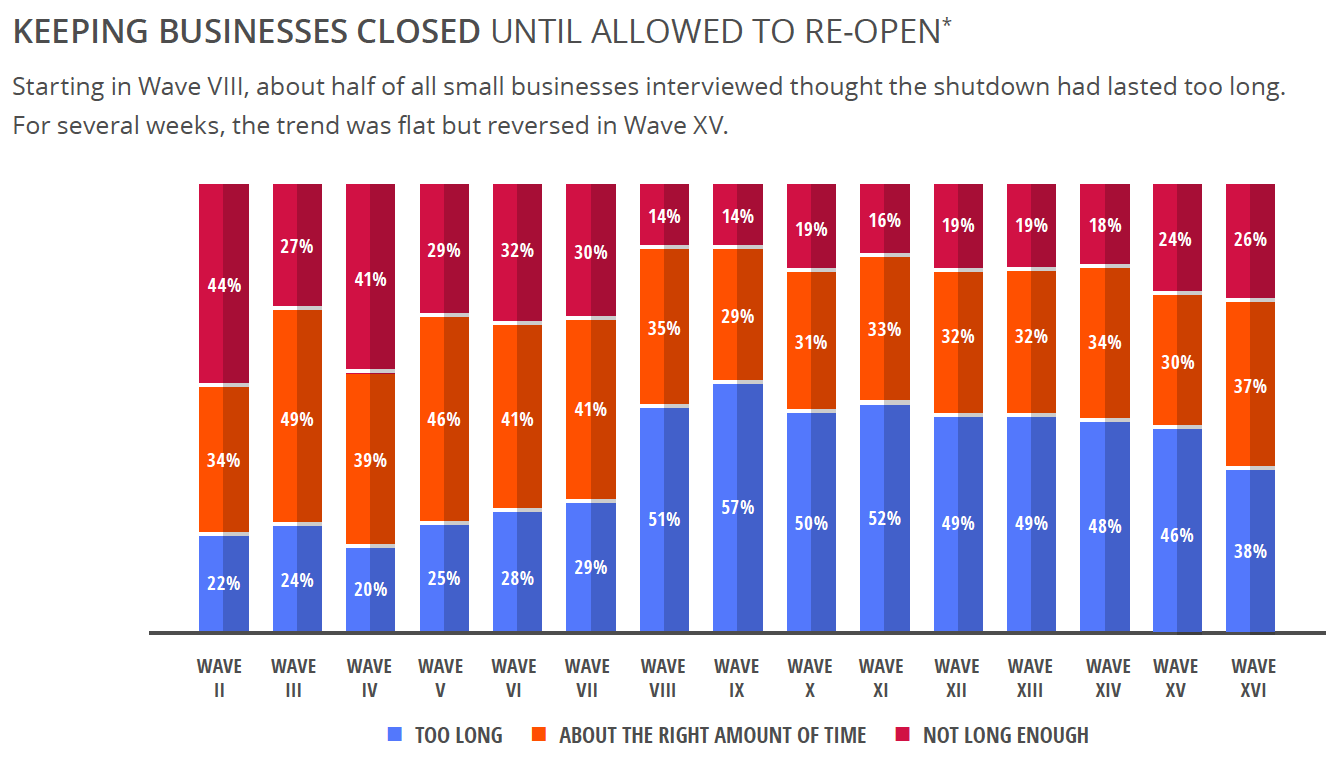

- More businesses, 26%, think the shutdown has not been long enough.

At the moment, small businesses are seeing little change in demand, however a growing number think it will begin to decline again.

- 64% are extremely concerned that they will experience large declines in demand.

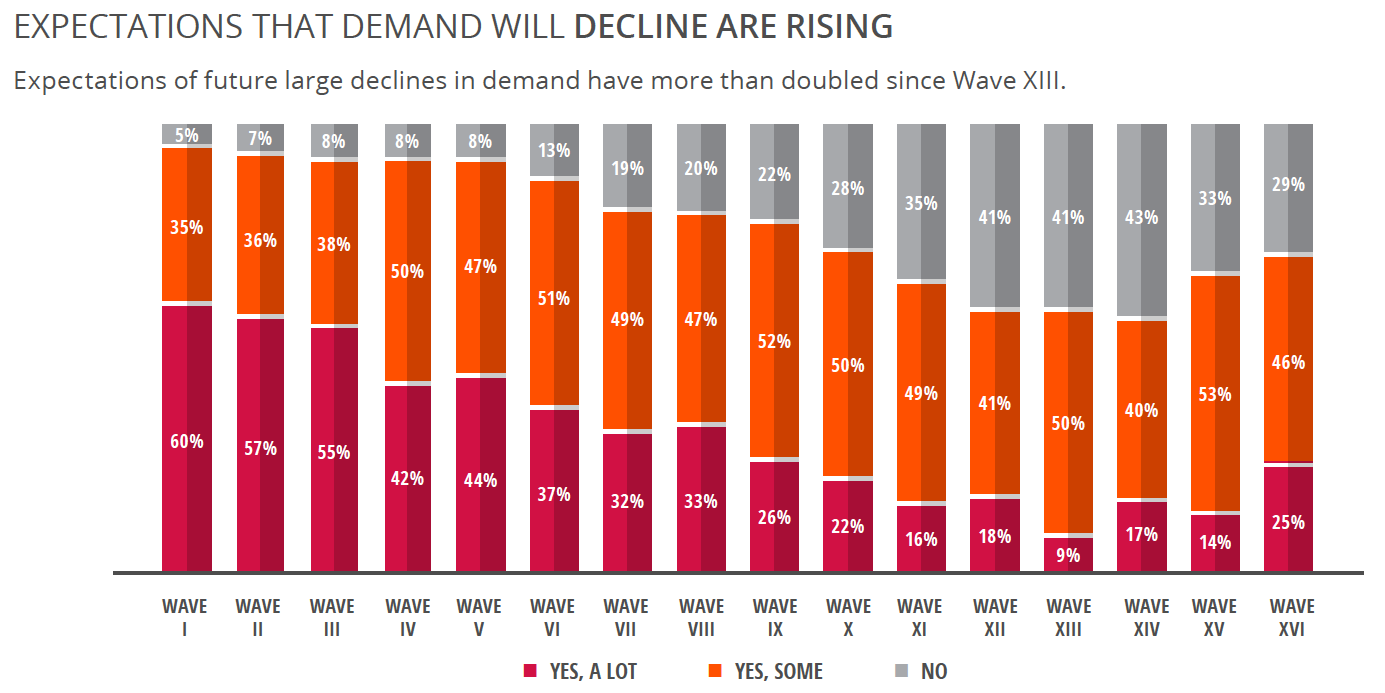

- 71% are expecting at least some level of decline in demand.

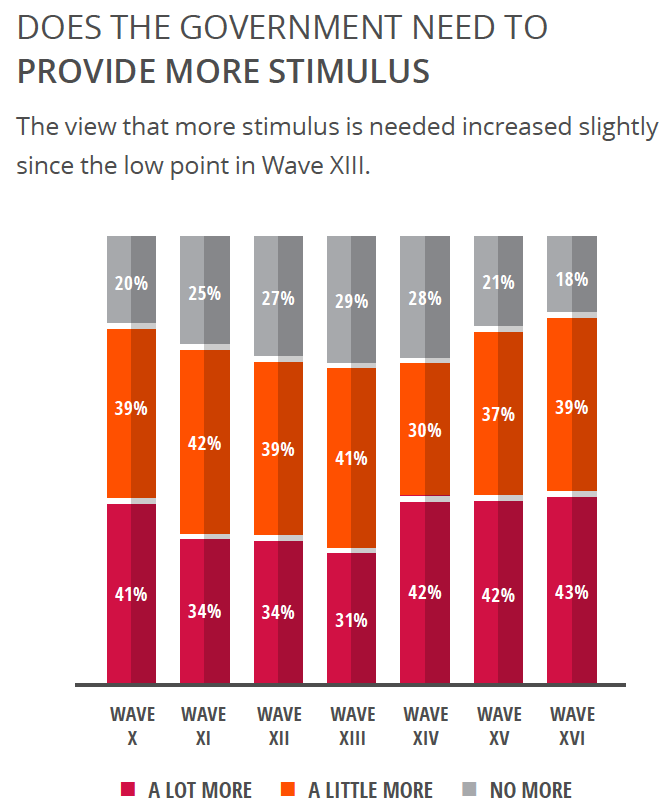

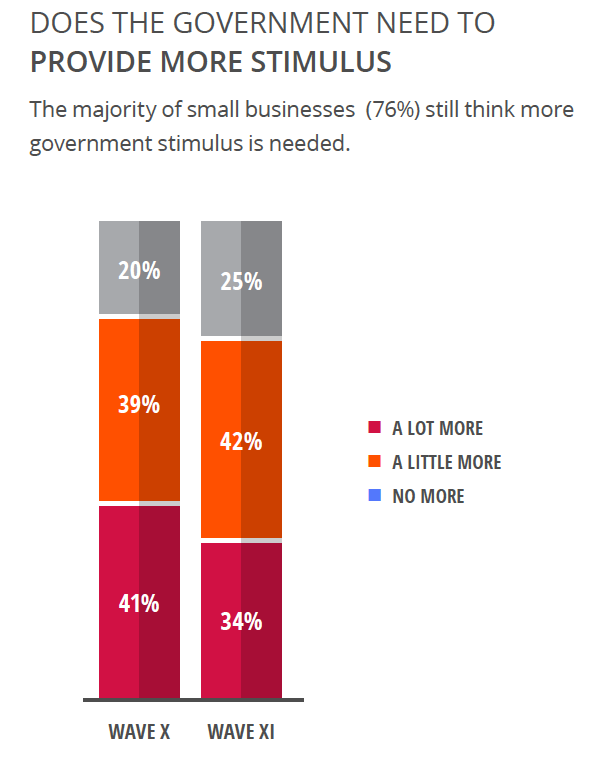

- 82% believe the government needs to provide at least a little more funding for small businesses.

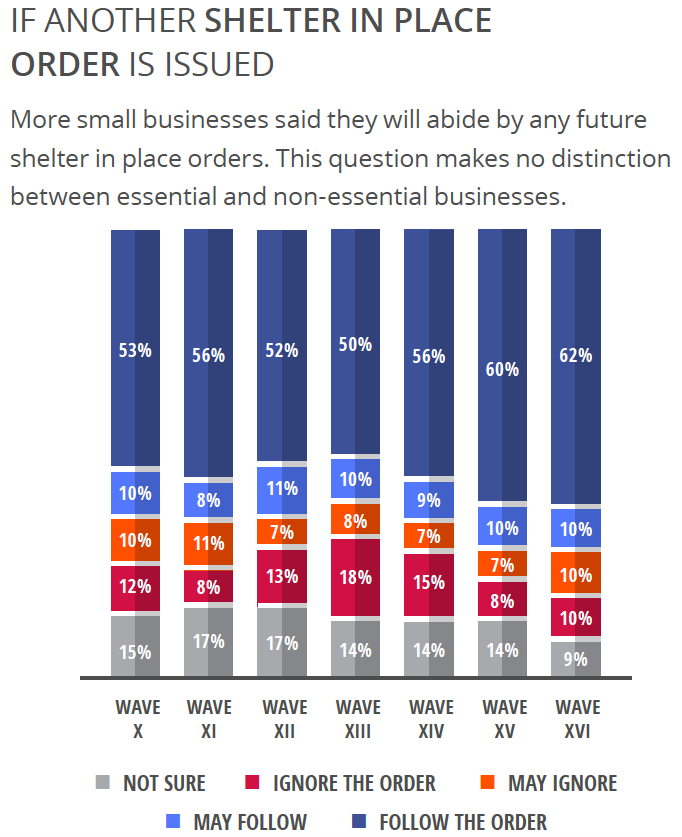

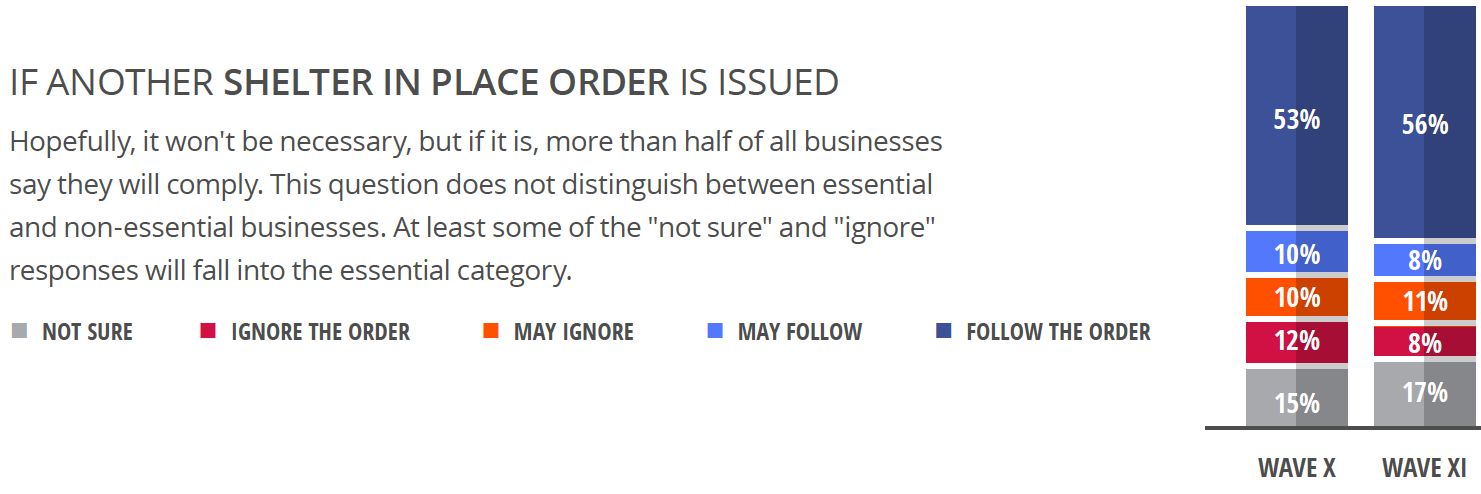

- Well over half say they will comply with future shelter-in-place orders.

13th Wave: Positive Trends Continue

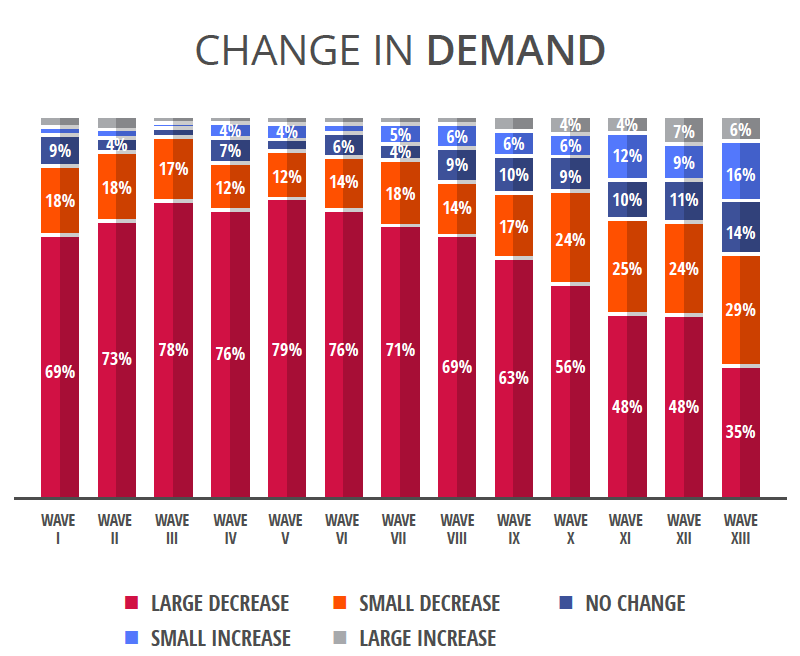

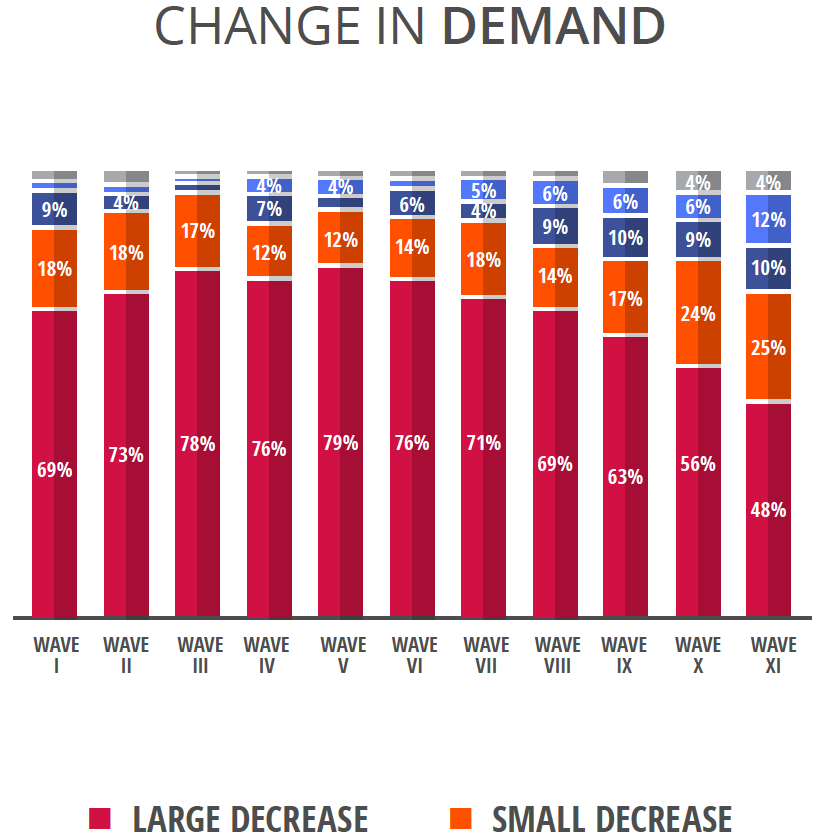

Earlier, in Wave 5, we saw large declines in demand at their highest level, with 79% of small businesses reporting severe slowdowns. In Wave 13, that number has fallen by more than half to its lowest level.

- Only 35% reported large declines in demand.

- Only 9% report that they expect demand to continue to decline a lot, down from 18% in Wave 12.

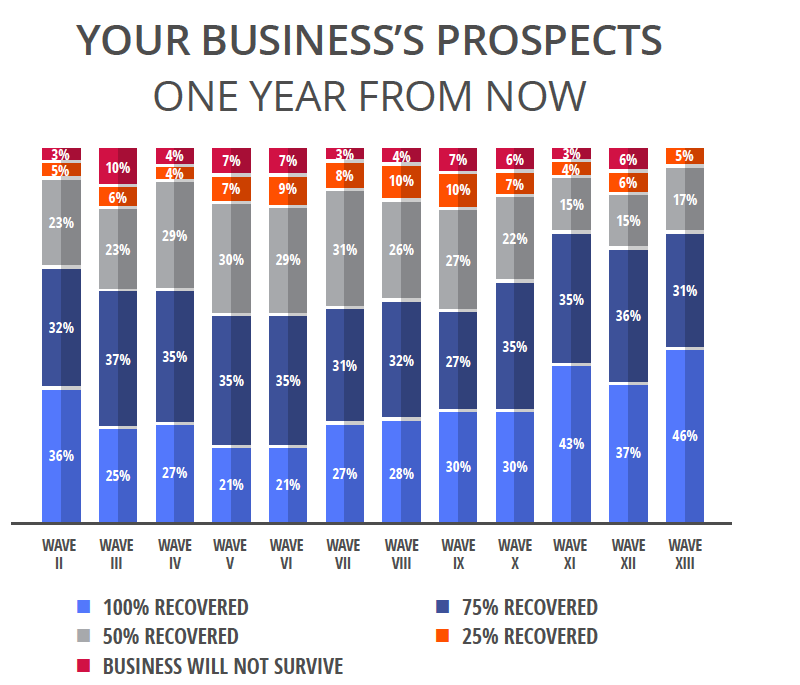

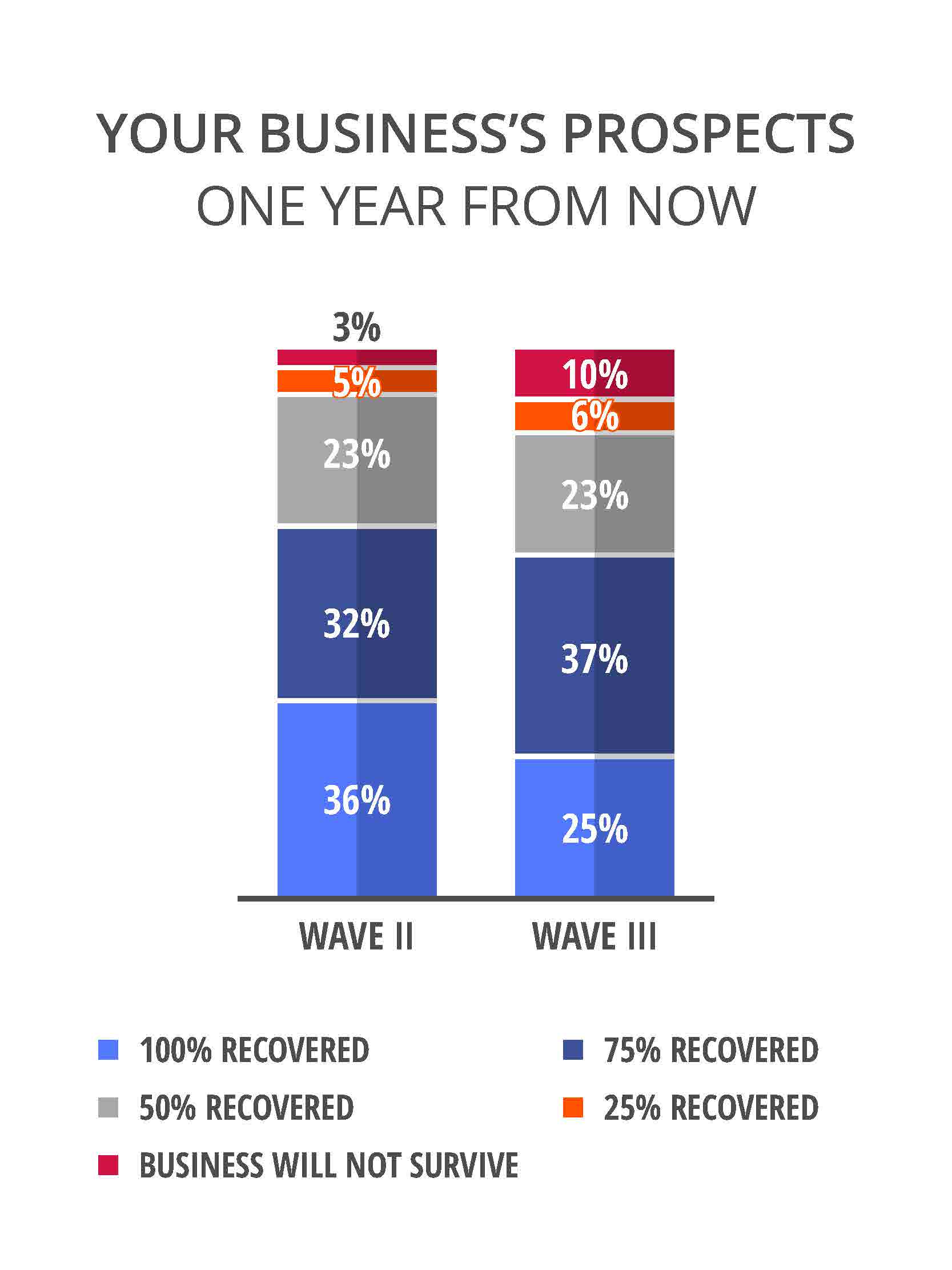

In previous waves, it appeared a downward trend in delayed or cancelled investment and expansion plans may have been developing. In Wave 13, this trend strengthened. With only a few exceptions, this number has hovered around 40% in previous waves. For the first time, none of the businesses said they did not believe their business will survive a year from now.

- Nearly 6 in 10 (59%) businesses said they had not delayed or cancelled plans for investments.

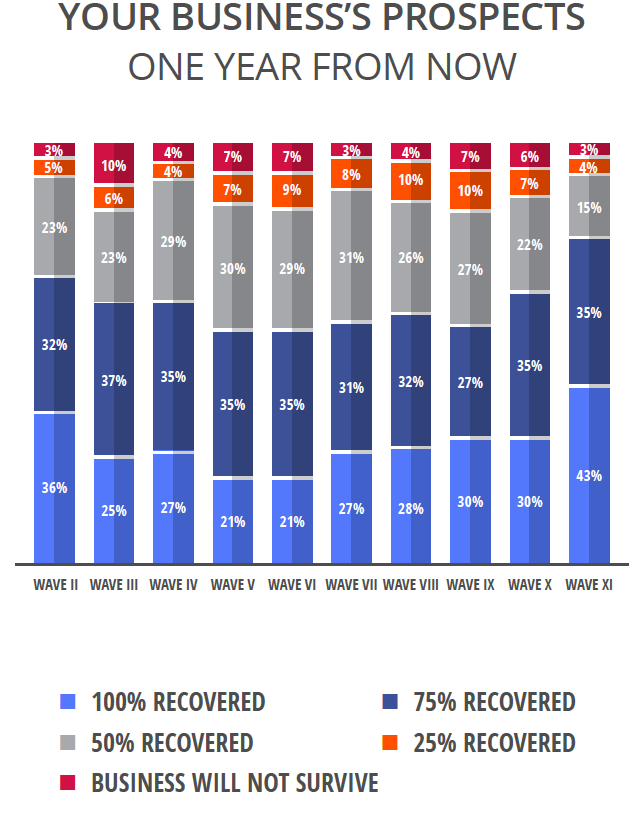

- 49% believe they will make a full recovery one year from now. This compares with a low of 21% in Waves 5 and 6.

More workers are back on the job, and only 5% of business said they are still closed.

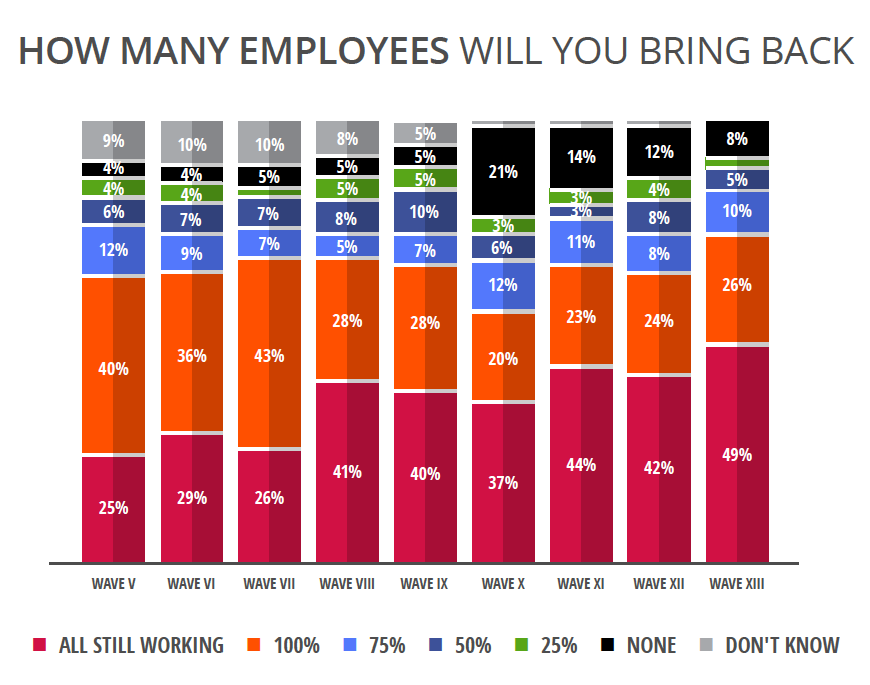

- 49% of those interviewed said all their employees were back work.

- Volume compared to 12 months ago continues to rise. In Wave 9 only 13% said they were at full capacity.

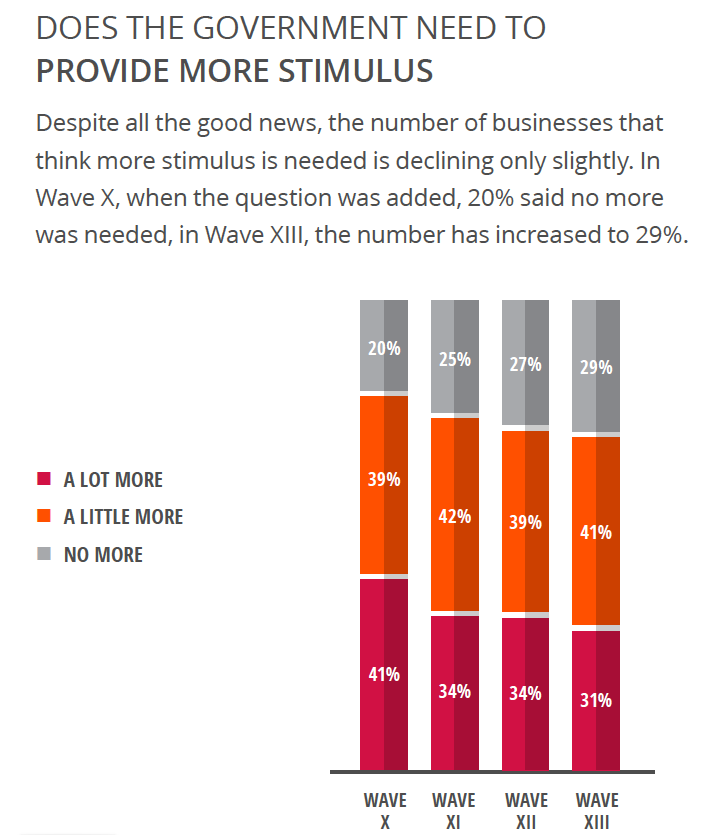

- Despite all the good news, 71% believe the government needs to provide more aid to small businesses.

Download the full Wave 13 report

Download the full Wave 13 report

10th & 11th Waves: More Small Businesses Expect to See Full Recovery within a Year

The 10th and 11th waves of the study has been completed, with the most recent wave occurring May 29 – 31. These waves show a more optimistic outlook, however many small businesses say more help is still needed.

- For the first time since the study began on March 20, the number of firms saying demand has increased by a small or large amount has risen above 10%.

- Recovery, one year from now, took a big leap in the positive direction in Wave 11, with 43% saying they would completely recover one year from now. That is an increase from the low (21%) in Wave 6.

While those responses were leaning more positive, most small businesses believe more help is needed.

- 76% of businesses still think more government stimulus is needed

- More than half are still concerned about a second outbreak of the virus

- Most businesses say they will comply if another closing is necessary

Download the full Wave 11 study findings.

Ninth Wave Shows Businesses are Torn about Safety & Reopening

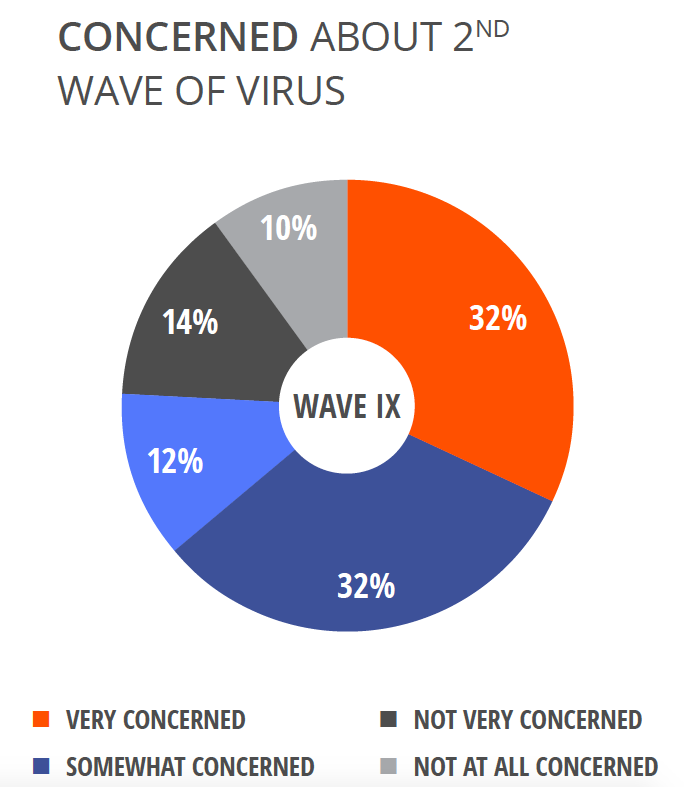

The ninth wave of the study has been completed, with the most recent wave occurring May 10 – 17. For this wave, small businesses answered new questions about concerns that a second wave of the virus is imminent and how their volume now compares to 12 months ago.

- Many of the trends continued in a positive direction. For instance, those saying they are extremely concerned about changes in demand has fallen below 70% for the first time since the study began.

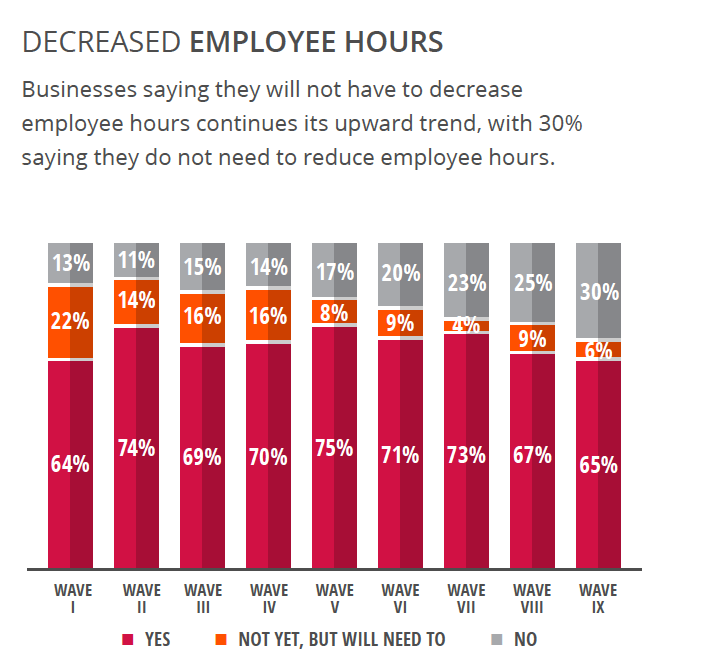

- Also, businesses saying they will not have to decrease employees hours has continued to improve, with 30% saying they do not need to reduce employee hours.

However, some businesses are torn between staying safe and the need to save their businesses.

- 64% are very or somewhat concerned about a second wave of the virus.

- However, more than half (57%) think waiting a couple more weeks to re-open is too long.

- Even among those that are concerned about a second wave of the virus, 38% think a couple more weeks is too long.

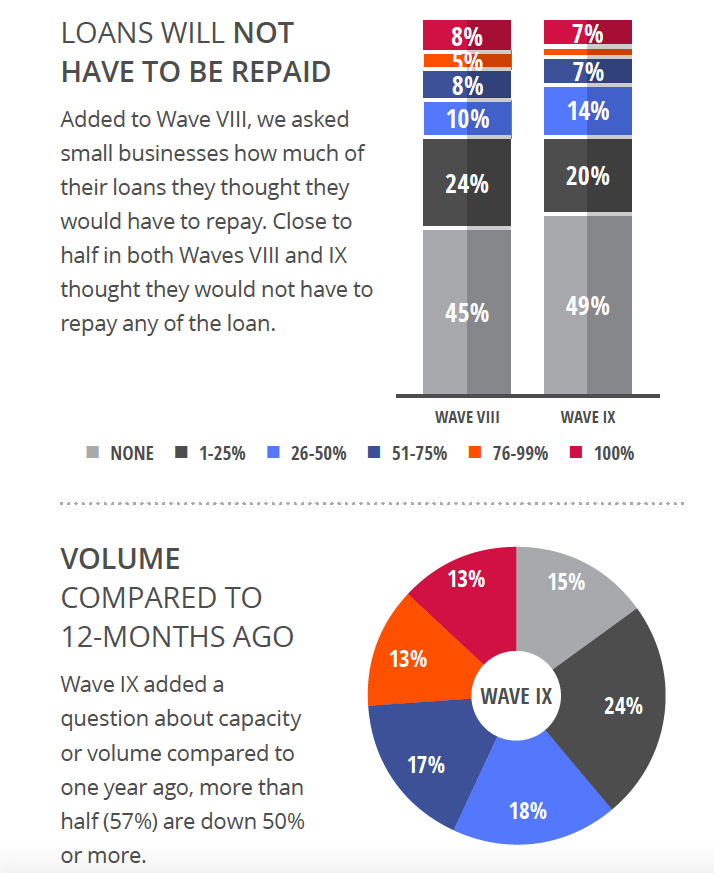

Other major impacts of COVID-19 include SBA loans and overall business volume.

- Almost half (49%) the small businesses that received an SBA loan think they will not need to repay it.

- Most (57%) small businesses are operating at 50% or less of their volume this time last year. Slightly less than 15% say they are operating at 100%.

Seventh and Eighth Waves Show Improved Level of Concern and Loan Payouts

Seventh and eighth waves of the study have been completed, with the most recent wave occurring May 4 – 10. The most significant changes show that business owners are beginning to feel less concerned and have received funding from the SBA.

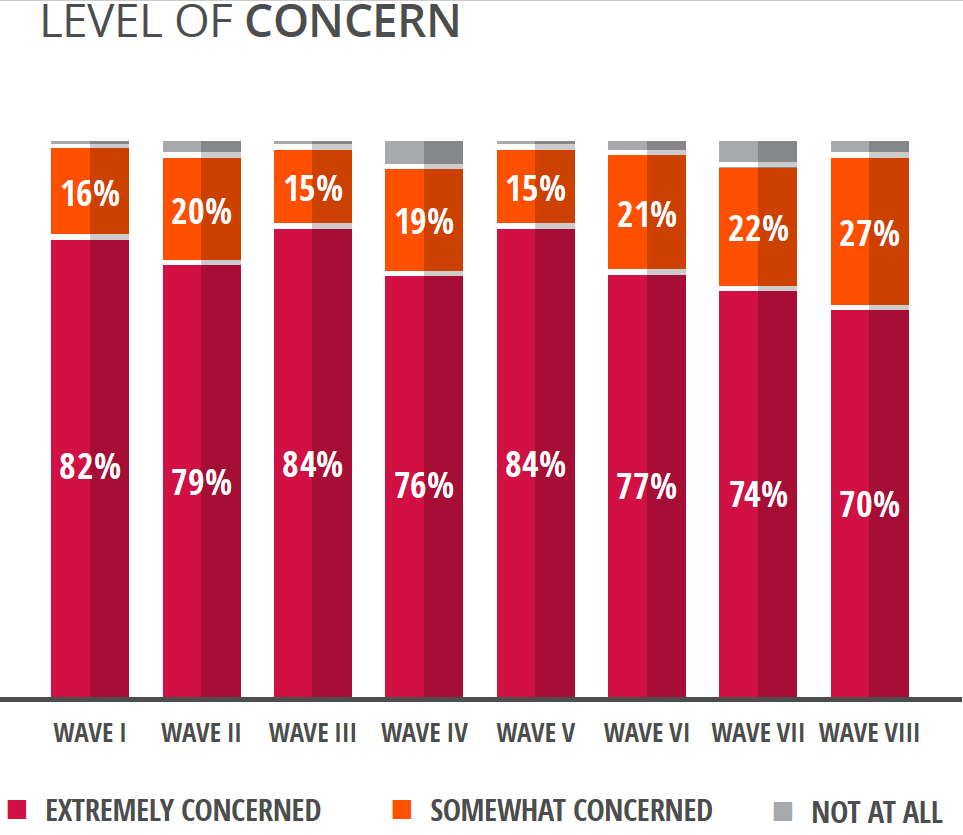

- The level of “extremely concerned” has hit its lowest point at 70% in Wave 8, down from 74% in Wave 7

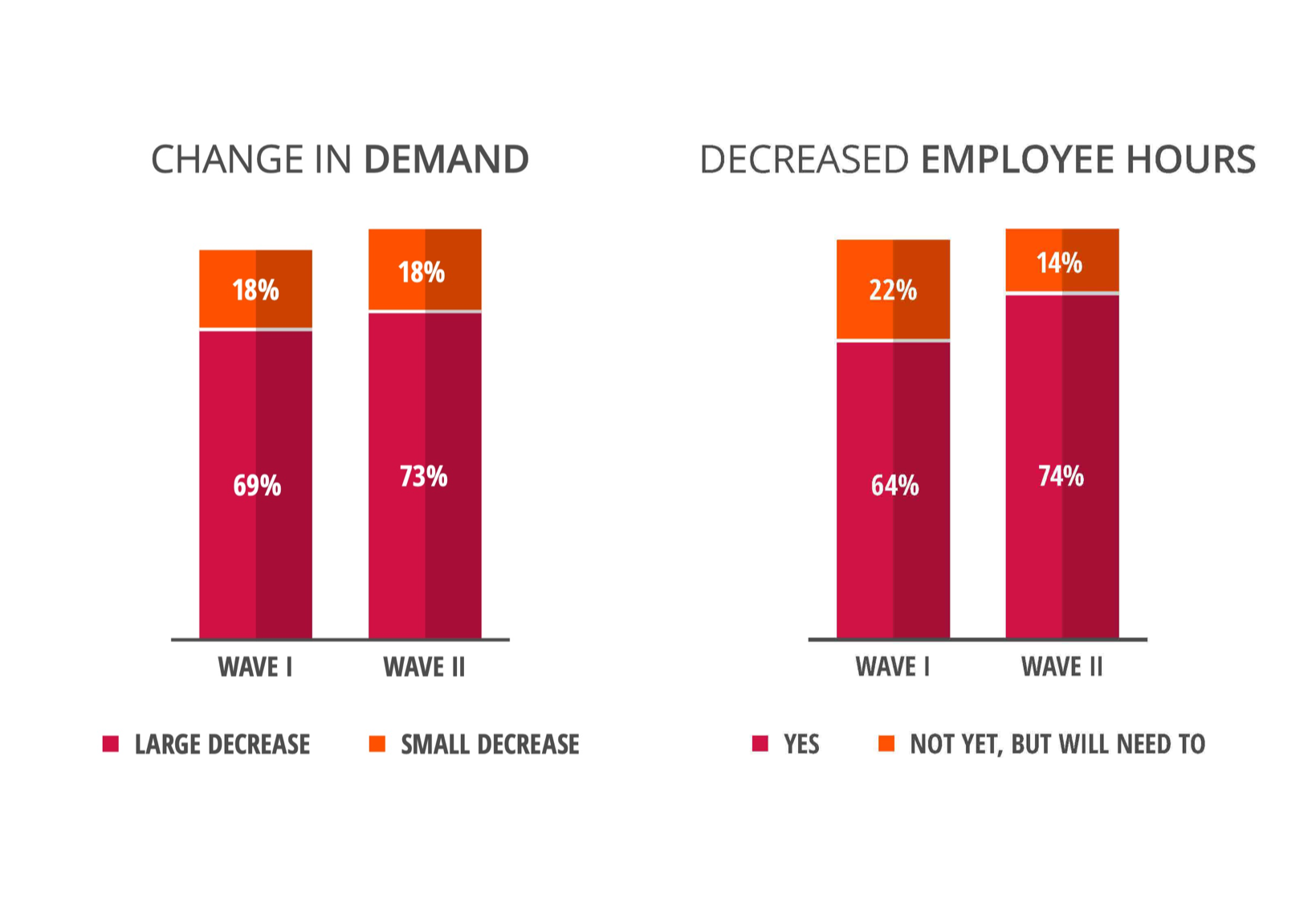

- The “large decrease” in change of demand has also dropped to 69% for the first time since Wave 1.

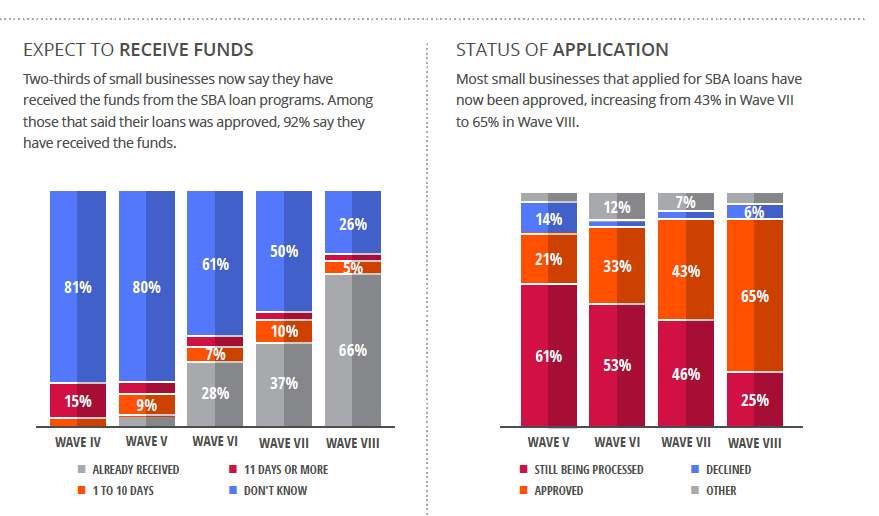

- Slightly more than one in four (28%) say they have received funds, up from 5% in Wave 5.

Additionally, feelings about bringing employees back and longer-term prospects are improving.

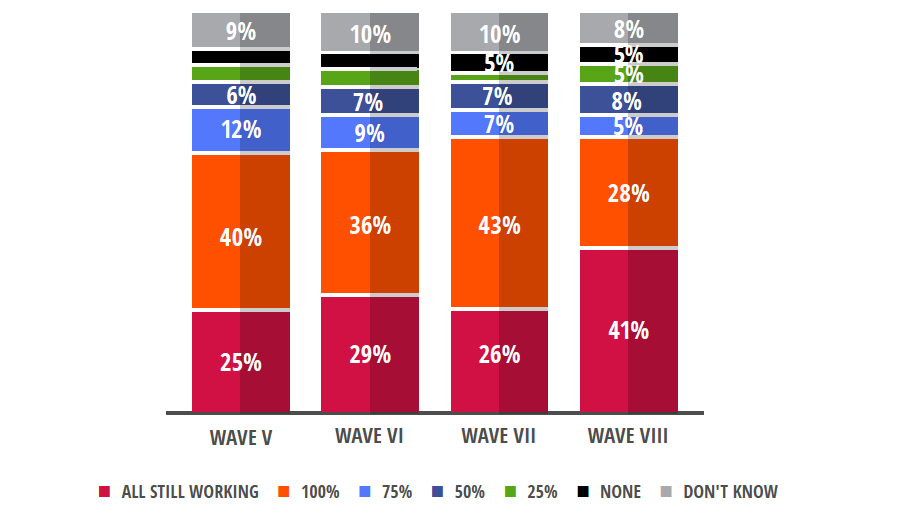

- The number of employees still working jumped to 41%, and another 28% said employees will return when they are allowed to reopen.

- Businesses that believe they would completely recover one year from now increased to 28% in Wave 8, up from 21% in Waves 5 and 6.

Applications and loan payouts saw significant changes, as well

- Most small businesses that applied for SBA loans have now been approved, increasing from 43% in Wave 7 to 65% in Wave 8.

- Among businesses that said their loans were approved, 92% said they had received the funds.

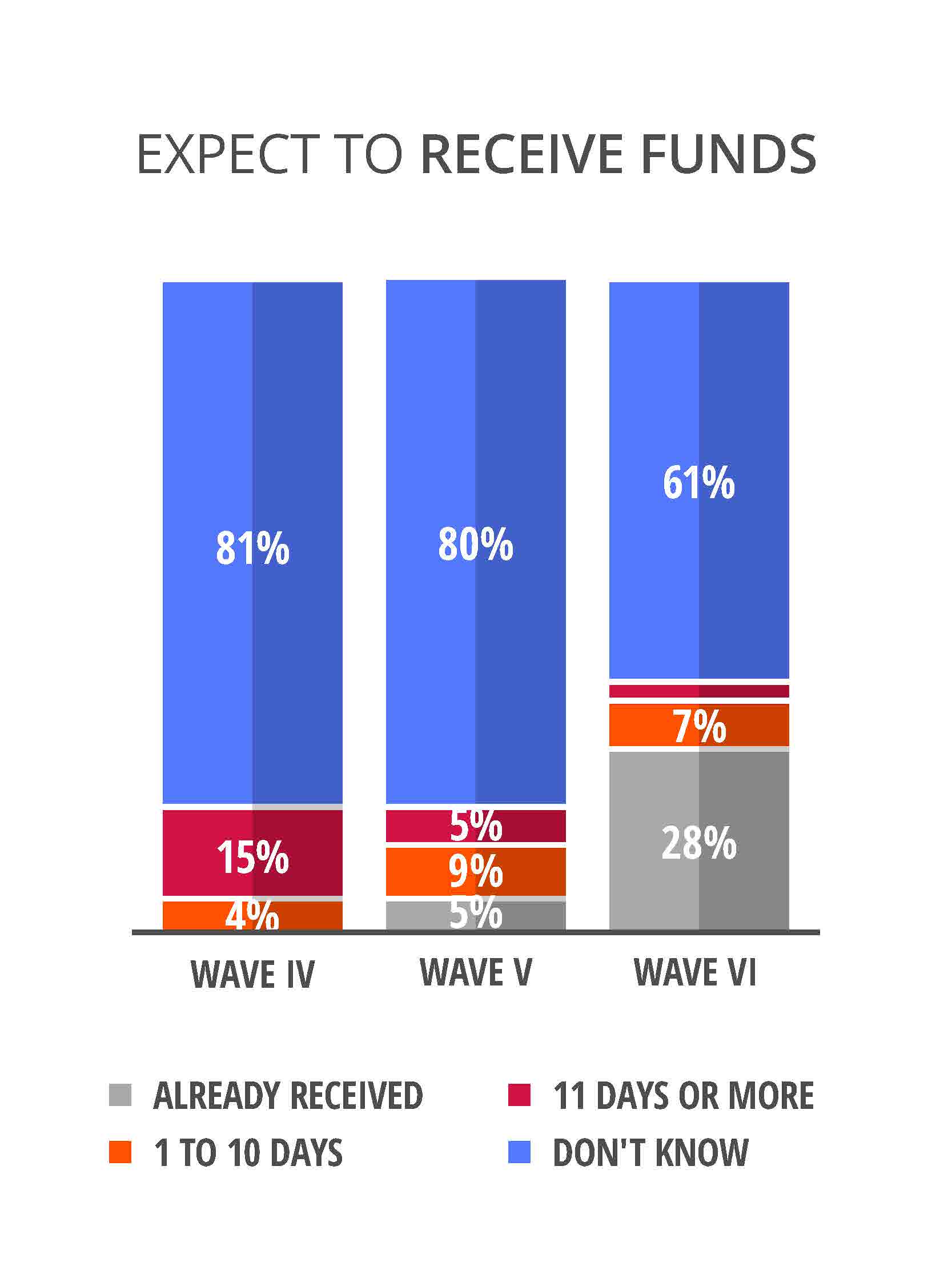

Sixth Wave of Study Reveals Status of Funding

A sixth wave of the study occurred April 24 – 26. The biggest change from Wave 5 is that funds have begun flowing for businesses in need.

- Slightly more than one in four (28%) say they have received funds, up from 5% in Wave 5.

- Most businesses (61%) say they have applied for SBA loans.

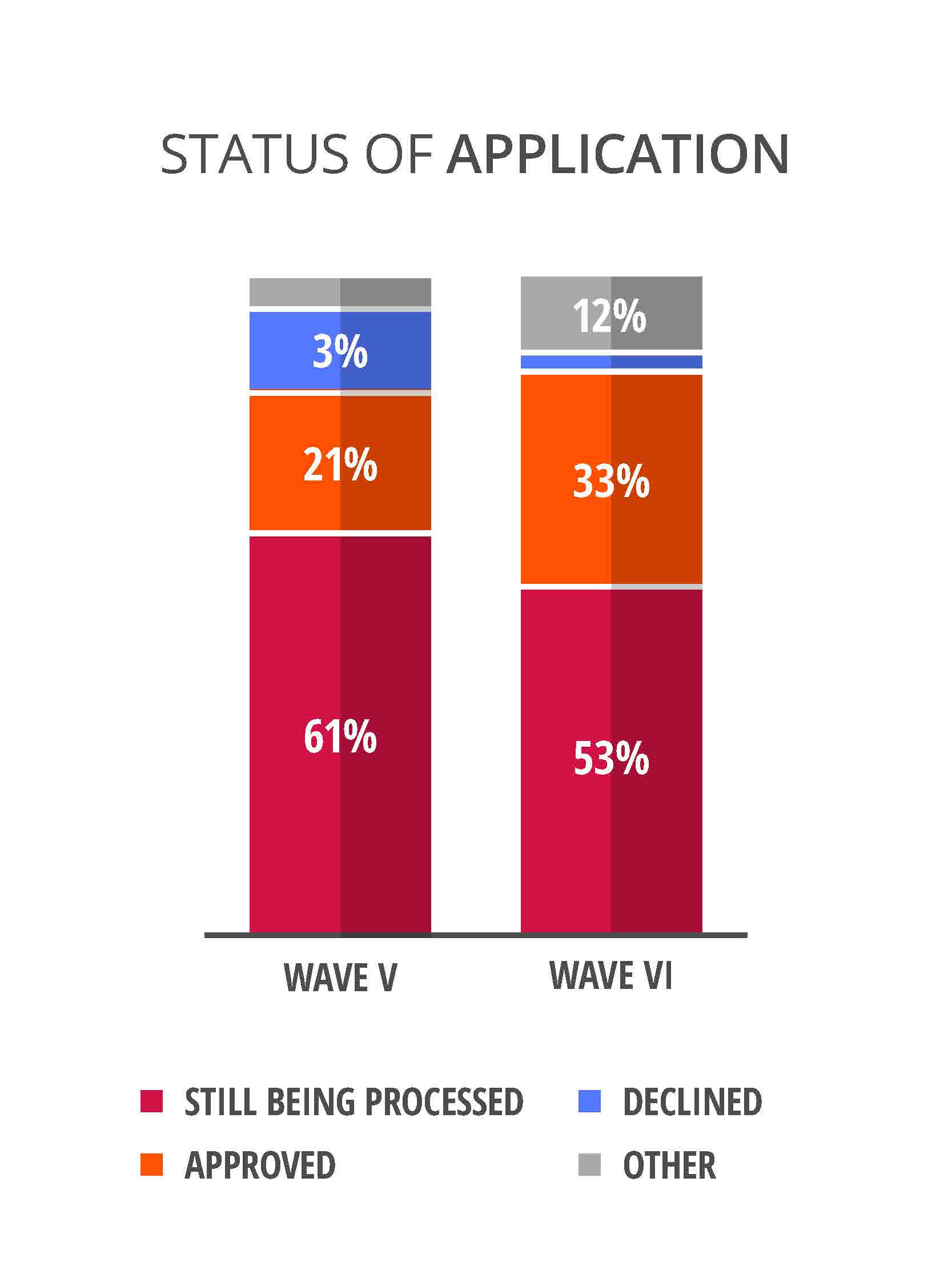

- One in three said their loan has been approved, increasing from 21% in Wave 5.

- Looking only at those who said they were approved for the loan, 78% said they had received the funds.

Download the full Wave 6 study findings.

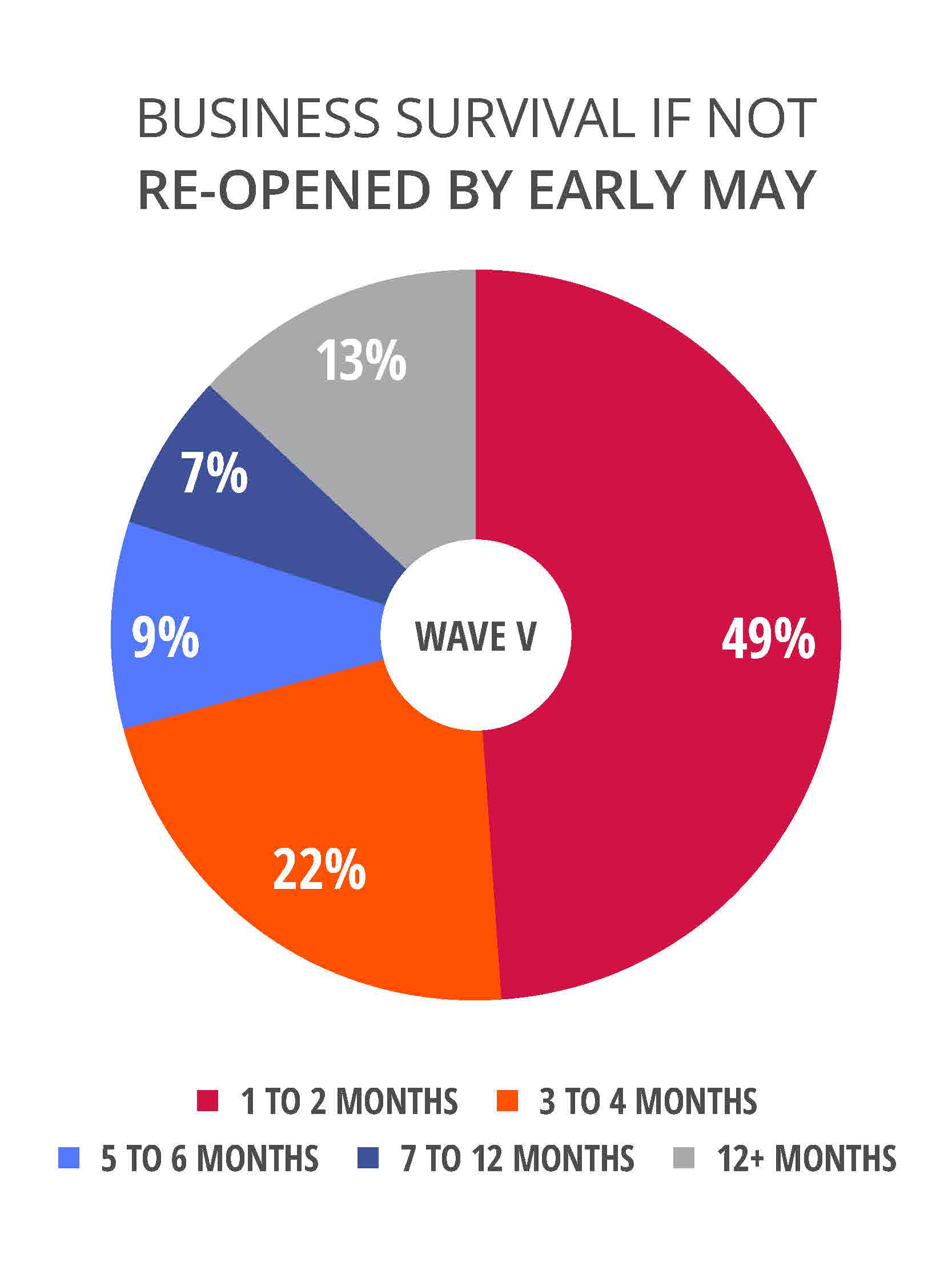

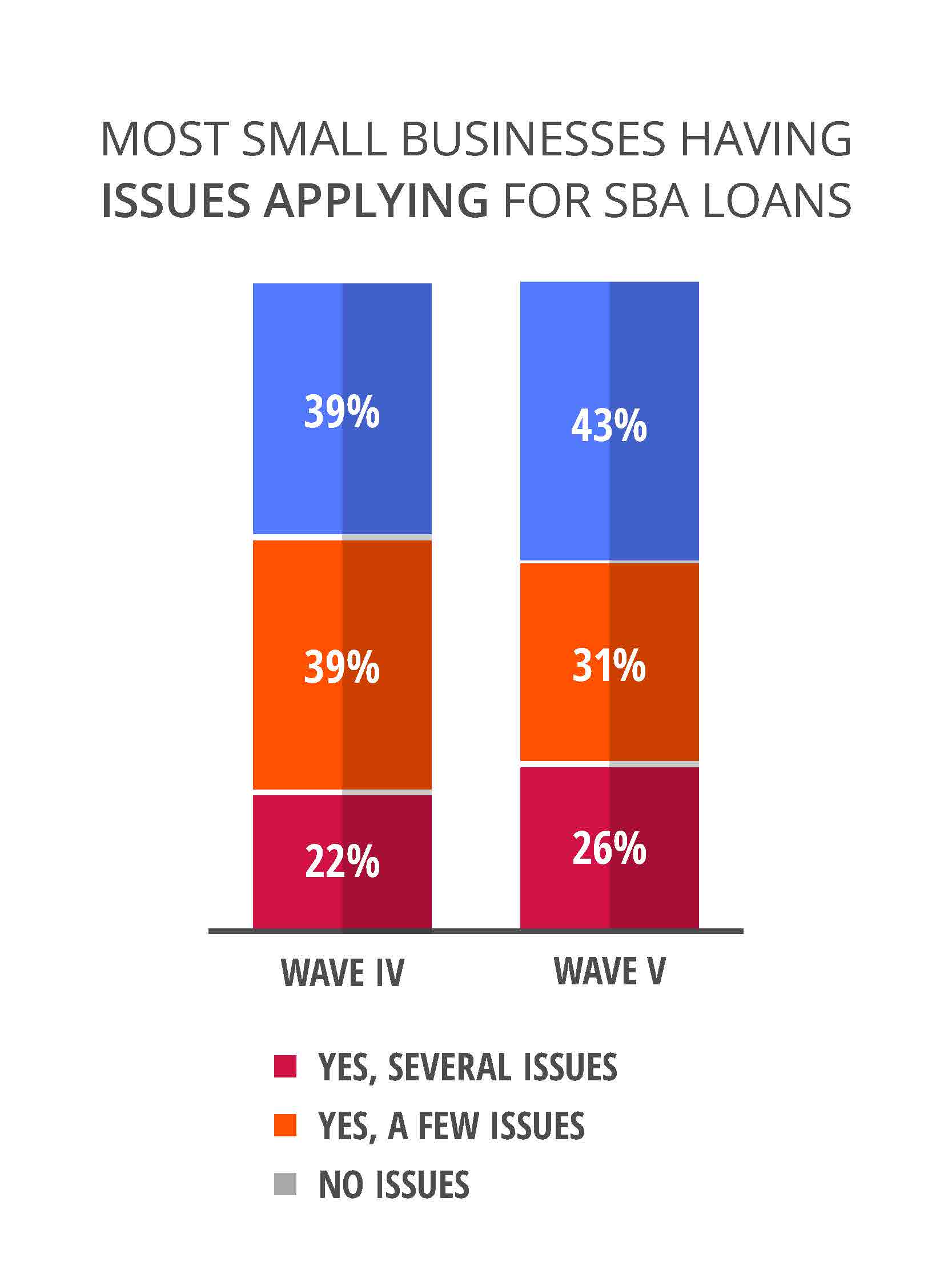

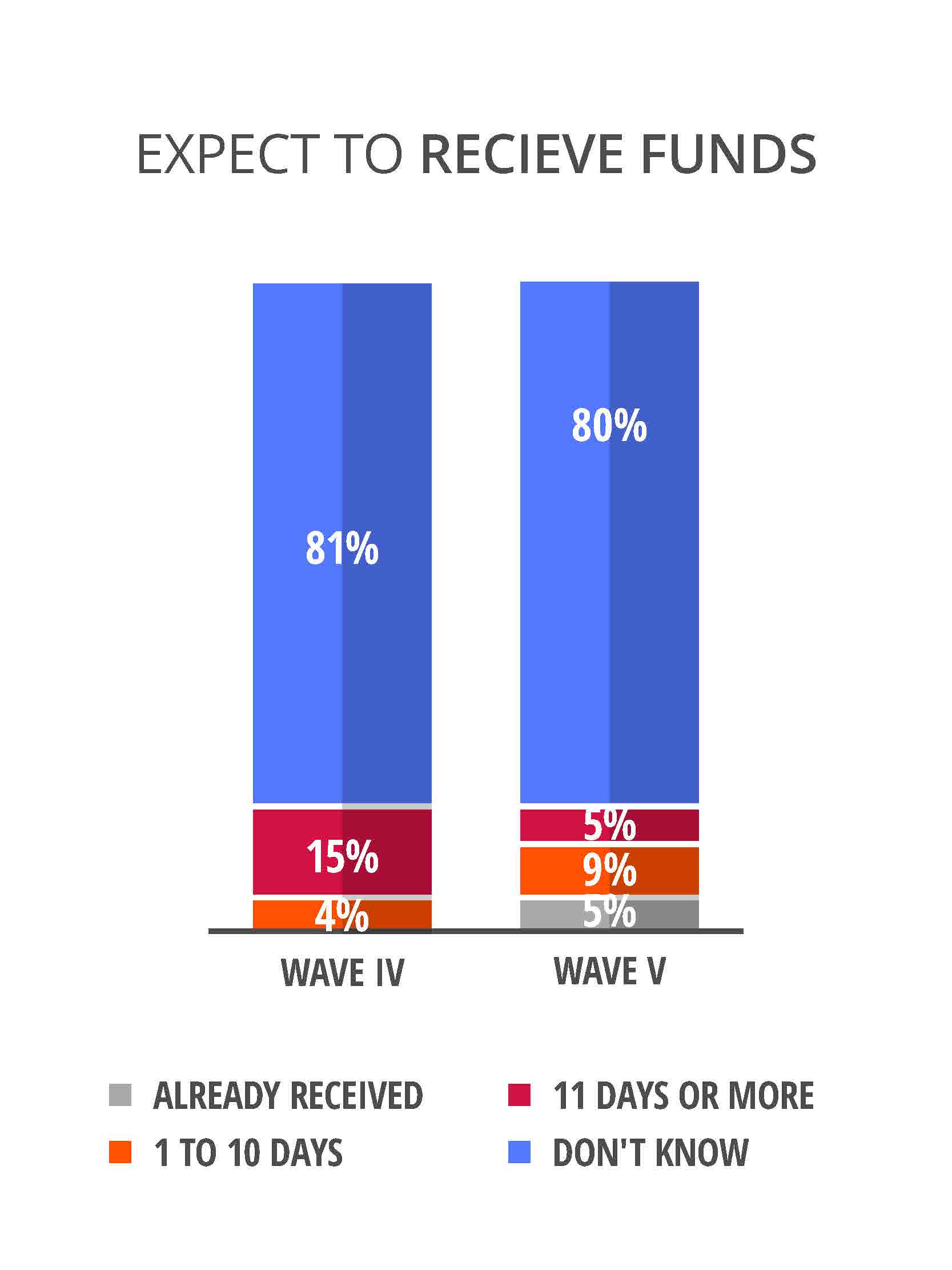

Fourth and Fifth Waves of Study Reveal Further Need for Funding to Re-open

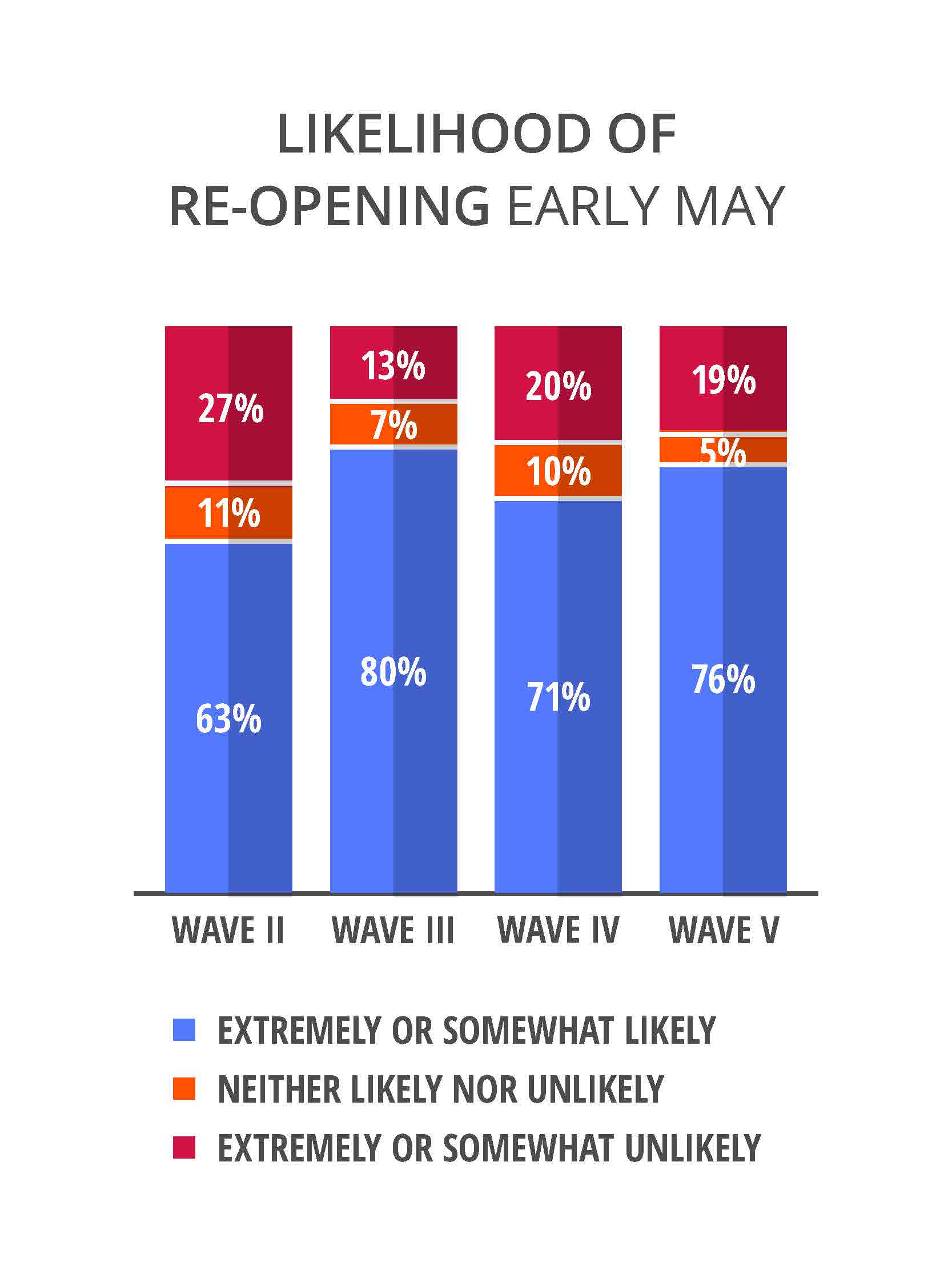

The fourth and fifth waves of the study occurred April 10 – 12 and 17 – 19, respectively. Compared to prior waves, small business owners expressed additional uncertainty on the prospects of reopening.

- 49% said they could only survive one or two more months if an early May reopening date is postponed.

- 76% say they’re likely to reopen early in May.

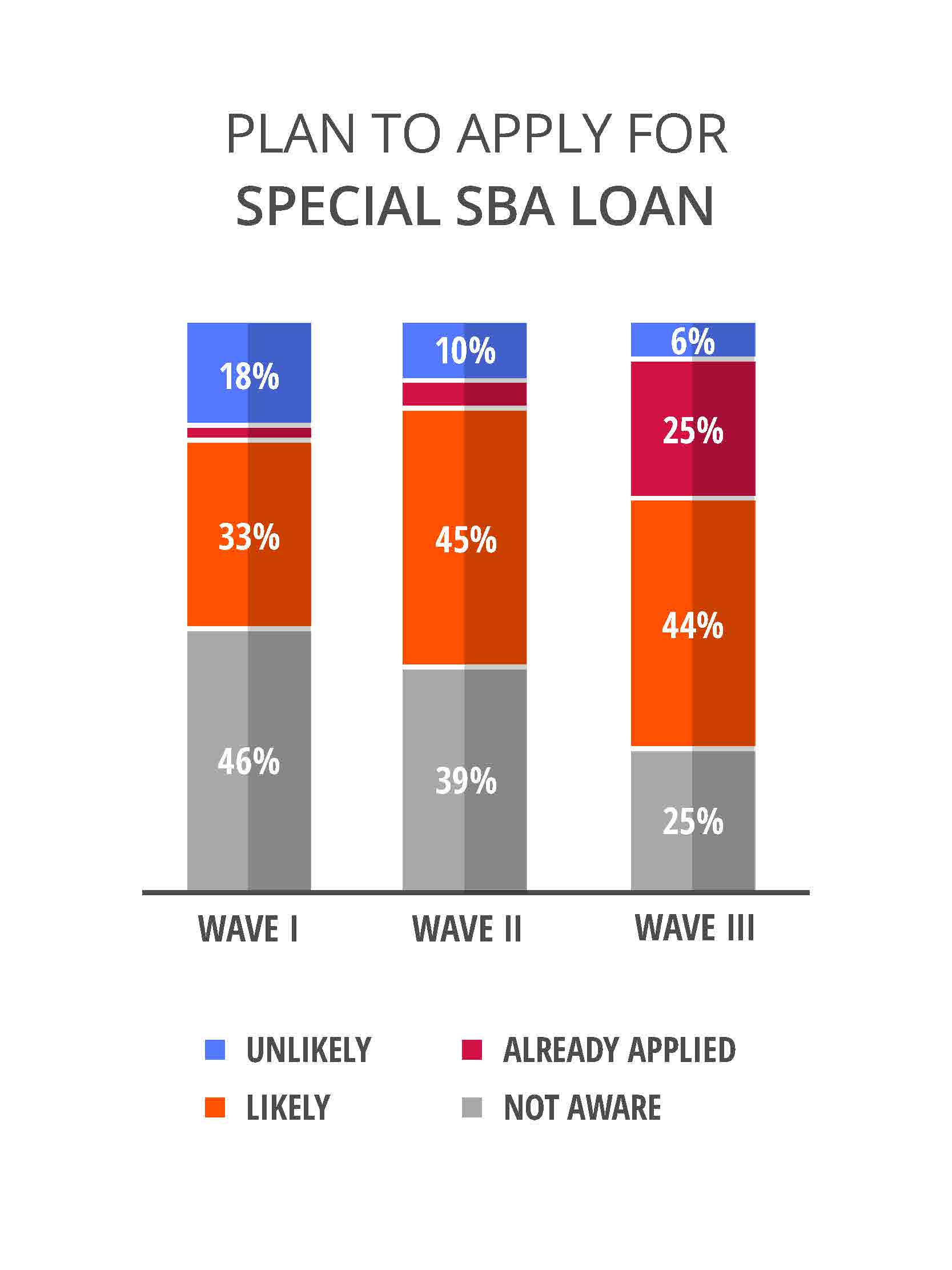

- More than half of small businesses in the study (58%) said they had applied for an SBA loan.

- But, more than half (57%) also experienced issues applying for the SBA loans.

- 80% of those who have applied say they do not know when they will receive funds.

- Only 5% say they’ve received the money.

Lastly, employee hours and staffing are also still being affected.

- 25% of small businesses said their employees are still working.

- 40% said they intended to bring back all of their employees.

- 12% said they would only bring back three-quarters of employees.

Third Wave of Study Finds Optimism about Timeline to Re-open

As a follow-up to earlier waves in the study, Thryv and America’s SBDC conducted a third wave of the study April 3 through April 5.

Their Wave 3 findings uncovered that while many business owners still express concerns about the future, others are thinking about the possibility of re-opening.

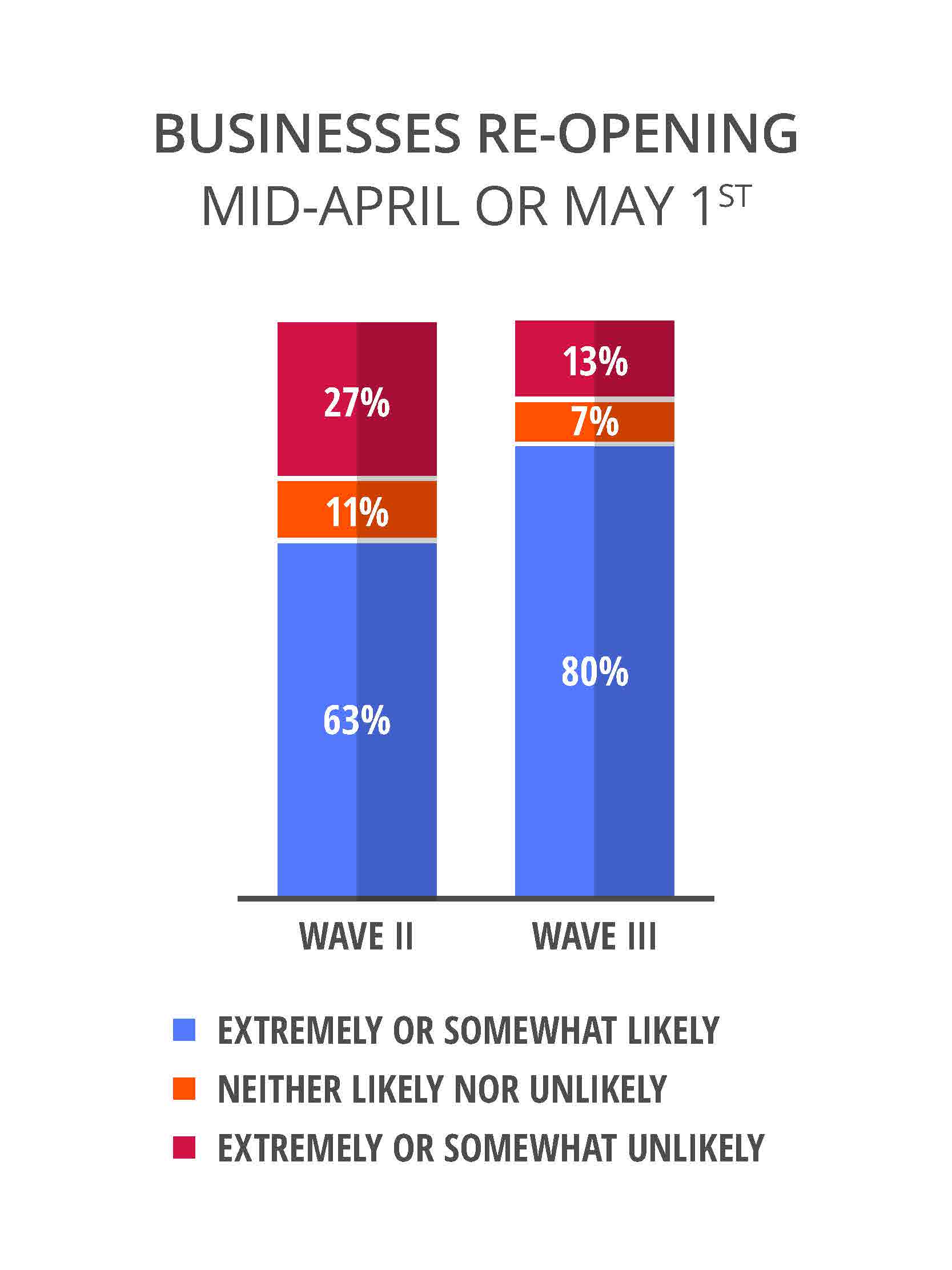

- 80% of small businesses indicate they’re likely to re-open by May 1, up from 63% who anticipated re-opening by mid-April in earlier findings.

- 44% (up from 33% in Wave 1) anticipate they’ll apply for an SBA Economic Disaster Loan

- 25% (up from 5% in Wave 2) say they’ve already applied for a disaster loan.

- 10% of businesses do not think they will survive, up from 3% in Wave 2.

- 6% of firms that have operated for less than 30 years say they will not survive.

- 16% of small businesses that are more than 30 years old said they would not survive.

The increase is driven by older businesses (16%), compared to younger businesses (6%).

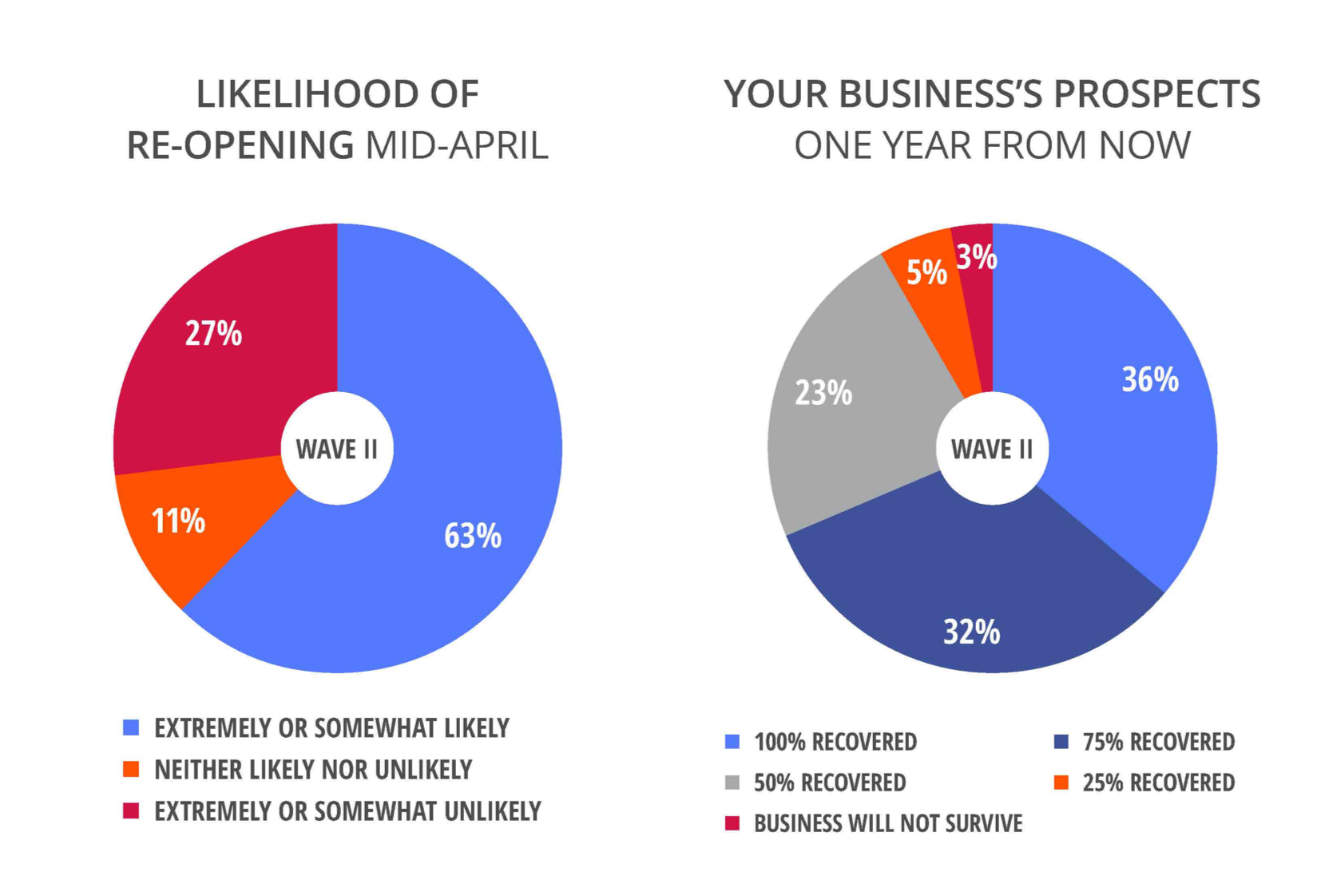

Second Wave of Study Saw Impacts on Employee Hours and Financial Future

While some conditions stayed largely the same from Wave 1 to Wave 2 of the study, the second wave (conducted March 27 through March 29) revealed larger implications on employee staffing and business owners’ plans for the future.

In short, Thryv and America’s SBDC found:

- 73% (up slightly from 69% in Wave 1) of U.S. small businesses have already experienced a large drop in demand due to the coronavirus pandemic.

- Nearly the same percentage of business owners expect demand to continue to decline.

- 79% of business owners are “extremely concerned” about the current business environment.

- 74% of businesses have decreased employee hours, compared to 64% in the first wave of the study.

When asked about the future (a new subset of questions added to the study Wave 2):

- 1 in 4 businesses indicated they were still open for business.

- 63% of remaining businesses claimed they’re likely to reopen by mid-April.

- 27% of remaining businesses claimed they’re unlikely to reopen by mid-April.

- 36% of business owners said they felt they’d completely recover one year from now.

- 3% said they do not believe they will survive the impacts of COVID-19.

Download the Impact of Coronavirus on Small Business study findings – Wave 2.

Initial Findings Indicated an Immediate Drop in Demand

Wave 1 of the study set a startling baseline. As of March 20 through March 23, and according to more than 850 small businesses:

- 82% of small businesses were “extremely concerned” about the current business environment in light of the COVID-19 outbreak.

- 69% of U.S. small businesses had already experienced a large drop in demand due to the coronavirus pandemic.

- 60% believed demand will continue to decline.

- 60% of small business respondents had delayed or cancelled plans for new investments, loans and expansions in light of the pandemic.

Most notably, the study revealed a sharp drop in consumer demand due to the virus. It also gave clear insight into the level of concern business owners have regarding the future.

Download the initial coronavirus study’s full findings.

Small Business Outlook in the Face of COVID-19

Thryv and America’s SBDC will continue to conduct further iterations of the study to uncover additional insights.

Check back for more information.

If your business is in need of resources or assistance:

- Apply for a federal disaster loan.

- Find your local SBDC.

- Use a ‘pay what you can’ version of Thryv – Thryv Adapt – during the crisis.

- Apply for a Thryv Small Business Foundation grant.

To stay up to date with the latest resources as they become available, subscribe to our blog.

Last updated June 23, 2020.

Modern Small

Business Playbook

Find expert tips and tools to help you streamline communications, automate your marketing efforts, improve your business operations, and more in this free guide.