In the past, the holiday season seemed synonymous with chaotic shopping; however, digital processes have made holiday shopping more convenient – both online and in stores.

As a small business, competing with big-box retailers can be difficult. But is there a silver lining? While retailers are doing away with their holiday layaway plans, now may be the time for your business to shine.

Could adding a Buy Now, Pay Later financing option could be the boost your small business needs this holiday season?

A New Way to Spend

The past 18 months have made many consumers more aware of their spending habits, especially after hiring builders to transform sheds into home offices and several trips to the hairstylist to color correct bad quarantine decisions.

But just because consumers are watching how much their spending, it doesn’t mean they’re done spending. If anything, they’ve discovered new ways to spend.

With consumers fearful of racking up debt, interest-free Buy Now, Pay Later offers advantages over credit card spending and is an enticing (and incentivizing) way for customers to purchase.

Unlike applying for a credit card, Buy Now, Pay Later options:

- Don’t run credit checks for approval

- Offer an interest- and fee-free choice*

- Force a quicker way to pay off items

Customers are 64% more likely to make a purchase when offered interest-free payment options.

By offering these installment plans, you set your business up to:

- Lessen shoppers’ buying hesitations

- Encourage bigger ticket purchases

- Expand customer base toward a younger generation

- Increase overall sales

- Better the customer experience

- Improve customer loyalty

As for your customers, they’ll gain a higher purchasing power once they have the ability to spread their payments equally over time.

Weigh the Cons

While the benefits of offering Buy Now, Pay Later are many, it’s important to consider the financial and planning drawbacks that come along with it.

- Compared to traditional payment methods, merchant fees attached to Buy Now, Pay Later systems are usually higher — ranging from 2-6%.

- Technology has flaws and sometimes integrating the Buy Now, Pay Later method into the checkout process requires a workaround and a few tech tools.

- Accreditation isn’t guaranteed because businesses must meet certain criteria to qualify for Buy Now, Pay Later payment methods.

When choosing to add on the Buy Now, Pay Later method for your business, it’s important to weigh your options to ensure the risks are worth the rewards.

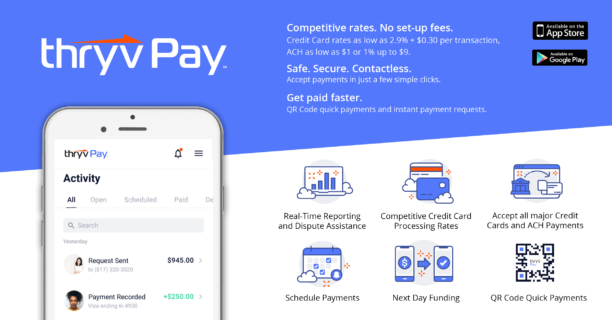

Did you know that you can set up customized scheduled payment plans with ThryvPay? Read more about it here.