Get paid faster with better small business payment solutions

Payment technology is constantly evolving, delivering more convenience for customers – and more ways for your small business to get paid faster. Online digital payments have become the preference for most customers, even when they’re making purchases in your store or engaging your services on site. Rather than paying in cash or check, customers today prefer digital wallets, touchless terminals, tap-to-pay platforms, smart phone apps and bank-to-bank transfers.

For customers, these digital payment solutions offer greater convenience and feel just as safe as paying with cash or check. For small businesses, digital payments can improve cash flow, simplify invoicing and increase customer satisfaction.

As a do-it-all platform for small business tools, Thryv offers multiple small business payment solutions to help you simplify online payment processing while giving customers the convenience they desire. Combining invoice and estimate software, payment processing and credit card software for small business, Thryv’s small business payment solutions help you get paid faster than ever before.

The benefits of digital payment solutions

Digital small business payment solutions deliver big advantages for managing your finances and cash flow.

Streamline invoicing

When you accept digital payments, it’s easy to send invoices via email or text with links that let customers pay using a credit card or digital wallet. Rather than preparing and sending paper invoices, online invoices eliminate extra steps and improve efficiency.

Deliver better customer experiences

Customers who value the convenience of digital payments will be more likely to continue to patronize your business.

Get paid faster

Allowing customers to pay online accelerates your cash flow. Rather than sending invoices that may get paid days or weeks later, you can send an email or text that allows customers to pay immediately.

Minimize expenses

Small business payment solutions reduce your costs in several ways. By automating many of the tasks involved in preparing, sending and following up on invoices, you can manage finances with less time and effort. Also, online invoicing eliminates the cost of printing and postage for invoices sent in the mail.

Gather intelligence

Digital small business payment solutions deliver lots of data about your customers, including information about their purchasing decisions and buying history. By analyzing this data, you can make more informed decisions about the types of products and services to offer each customer segment and how you can personalize your marketing communications.

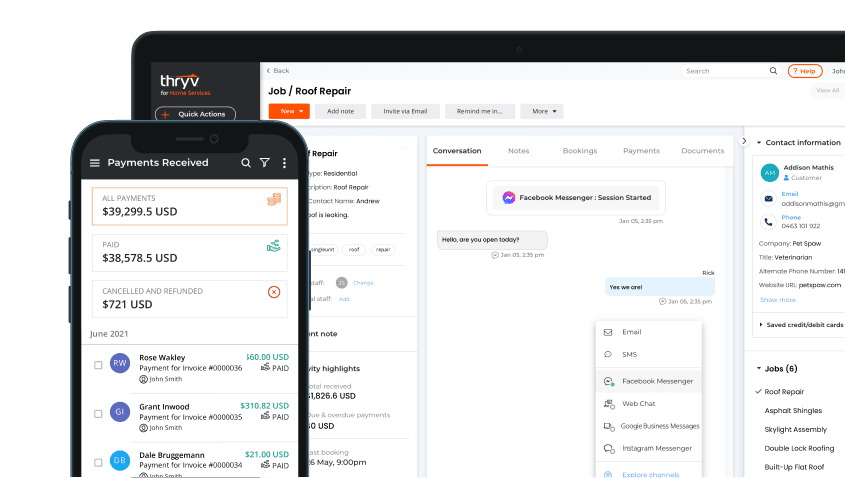

Small business payment solutions from Thryv

Thryv offers end-to-end solutions for communicating with customers, running your day-to-day operations and growing your business. From estimate software for contractors to CRM solutions for wedding planners, Thryv offers comprehensive tools for small businesses in a wide range of fields.

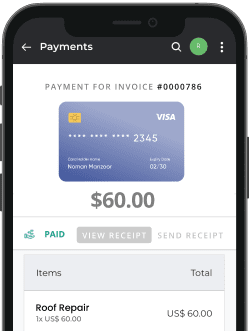

Thryv’s small business payment solutions include ThryvPay, an online payment processing system with low rates and no hidden fees. With ThryvPay, you can:

- Easily accept credit card, ACH and digital payments.

- Offset processing costs by automatically charging convenience fees.

- Get next-day funding.

- Integrate data with QuickBooks for automatic reconciliation.

- Accept tips from customers.

- Improve security with fraud prevention.

- Offer mobile payments with the ThryvPay Mobile app.

- Accept payments phone-to-phone or card-to-phone with Mobile Tap-to-Pay.

- Generate recurring revenue by accepting daily, weekly or monthly recurring payments.

Additional small business payment solutions from Thryv include:

- Online invoices. Send invoices, estimates and quotes from anywhere with Thryv’s interactive invoice and estimate software, allowing customers to approve and pay online as well.

- Credit card processing. Thryv’s credit card processing services process credit cards swiftly at extremely competitive rates, thanks to partnerships with industry-leading payment processors.

- Flexible options. Let customers pay in advance or with installment plans. Accept payments any time – when appointments are booked, at the time of service, or at a later date.

- Fraud prevention. ThryvPay partners with Plaid for fraud prevention, helping you prevent returned checks and saving thousands of dollars on fees.

Thryv’s comprehensive business management platform

Along with small business payment solutions, the Thryv platform delivers comprehensive tools to help you manage nearly every aspect of your business more efficiently.

Centralize communications with Thryv Command Center

- Thryv’s unified inbox combines conversations and messages across every channel where you interact with customers – email, phone, text, DM and more. With a consolidated view of all your messages and a single view of each customer’s communication history, you can quickly catch up on messages and respond to customers on their channel of choice.

- Manage voice and video calls with one business line.

- Get transcriptions of each voicemail delivered to your central inbox, so you can quickly find and reference customer information.

- Keep your team up to date with TeamChat. Send direct messages, set up group chats and mark up and share photos to keep everyone on the same page.

Streamline administration with Thryv Business Center

- Save up to 18 hours each week by automating tasks and pushing less paper.i

- Let customers book or request appointments online, freeing you from answering the phone all day.

- Simplify social media by posting to multiple accounts from one location. Create content quickly with easy-to-use templates.

- Manage documents easily with tools for online document signing, storage and sharing.

- Automate email and text marketing campaigns, sending the best message to each customer at the right time.

- Monitor and respond to online reviews quickly with help from Thryv.

- Let Thryv optimize your Google Business Profile and update your local listings so customers can find you faster.

Grow your business with Thryv Marketing Center

- Conduct smart marketing campaigns on Google, Bing, Facebook and other channels.

- Build high-performing ads in minutes from a library of pre-written templates.

- Get competitive insights and real-time analytics to measure your marketing success.

- Get AI-powered recommendations for ways to reach customers more effectively.

- Create compelling landing pages for paid ads in minutes.

Why Thryv?

Trusted by 66,000+ small businesses, Thryv provides everything from estimating software for plumbers and scheduling software for salons to marketing automation tools for repair shops and document management solutions for medical offices. With Thryv, you get:

- One login and one dashboard. Thryv’s platform offers a dashboard with all the solutions you need each day, accessible via one login. That means you no longer need to move back and forth between different applications and browser windows all day long.

- Business tools wherever you need them. Thryv puts the tools you need to run your business at your fingertips, no matter where you go. You can access Thryv from any location, on any device – mobile phone, tablet, laptop or desktop.

- Seamless integration. Thryv integrates with the productivity tools your team already uses such as QuickBooks, Indeed, Gmail, Zoom and many others. You don’t have to abandon the software that you know as you get up to speed on the Thryv platform.

- Effective security. Cutting-edge encryption and customizable account access controls ensure that confidential customer information and sensitive business data are constantly protected.

- Unlimited support. Thryv is the only small business software of its kind that offers unlimited, personalized support from representatives who are both small business specialists and technical experts.

i

Based on Thryv survey sample of 181 clients. Calculations assume a 40-hour work week. Results may vary.