How to Choose an Insurance Policy for Your Roofing Business

Roofing is one of the most hands-on and high-risk trades in the construction industry. Whether you’re just starting a roofing business or you’re a seasoned pro, one thing’s certain: having the right roofing insurance is essential.

This guide breaks down what coverage you need, how to pick the right provider, and how to protect your roofing business, without breaking the bank.

Why insurance matters for roofers

Even with safety training, smart planning, and experienced crews, accidents and unexpected issues can happen. One slip on a broken shingle or one customer dispute could cost your business thousands – or even force you to close shop.

That’s why roofing business insurance is a must.

This type of insurance can:

- Protect your financial future from lawsuits, property damage, and injury claims.

- Build trust with customers, general contractors, and partners.

- Help you win more bids by showing you’re insured and reliable.

It may even be required to obtain or keep your roofing license.

In short, insurance for roofing is an investment in your reputation, your peace of mind, and your long-term growth.

The top 6 types of insurance for roofing businesses

Roofing involves high-risk work, expensive tools, and constant customer interaction. To protect every corner of your operation, you’ll want to consider a combination of core and optional roofing insurance policies.

Here’s a detailed breakdown of each type and how they may help you:

General liability insurance

This is the backbone of most roofer insurance plans. It protects your business from claims involving third-party bodily injury, property damage, or personal injury (like slander or libel). It also covers legal defense and settlement costs.

Example: A homeowner trips over your air hose and fractures their wrist. General liability helps pay for their medical bills, legal fees if they sue, and even repairs on any property damaged during the job.

This type of roofing business insurance is typically required to bid on projects, primarily commercial or municipal jobs, and it’s often needed to maintain your roofing license.

Workers’ compensation insurance

If you have employees – even just one – most states legally require you to carry workers’ comp. This insurance pays for medical care, lost wages, rehabilitation, and sometimes death benefits if a team member is injured or becomes ill on the job.

Example: A roofer slips on a steep slope and suffers a back injury. Workers’ comp covers their ER visit, physical therapy, and a portion of their income while they recover.

Because roofing work is so physically demanding and carries a higher-than-average risk of injury, workers’ comp is one of the most critical forms of insurance for roofers.

Commercial auto insurance

If you or your employees drive work vehicles – whether it’s a pickup truck hauling shingles or a van carrying all your tools – you’ll need commercial auto insurance. Personal auto policies don’t cover business use.

Example: Your crew van is involved in an accident on the way to a job site. Commercial auto insurance can help pay for vehicle damage, medical bills, rental vehicles, and even legal fees if someone else is injured.

Some policies also include protection against theft, vandalism, and uninsured drivers – common concerns in high-traffic construction zones.

Tools and equipment insurance

Roofing requires a lot of valuable equipment – nail guns, ladders, generators, safety gear, and more. Tools and equipment insurance (also known as inland marine insurance) covers these assets against theft, accidental damage, and even loss.

Example: Your trailer is broken into overnight, and thousands of dollars in power tools are stolen. This policy helps replace them quickly, so you can get back to work.

Many plans cover items stored at your shop, in transit, or on the job site.

Professional liability insurance

This policy covers claims of negligence, faulty advice, or failure to deliver a promised result – even if the issue wasn’t intentional. If a customer claims your work caused financial damage or delays, professional liability insurance steps in to cover you.

Example: You complete a flat roof install, but a design oversight causes drainage issues that delay a commercial opening. The customer sues for lost revenue, and this policy helps cover the legal costs.

This is especially valuable for roofers who provide inspections, expert opinions, or consulting services – and it’s a smart extra layer of insurance for roofing businesses looking to reduce risk.

Commercial property insurance (optional)

If you operate out of a physical location, such as a warehouse, storefront, or dedicated office, commercial property insurance protects your building, materials, and contents from covered perils like fire, theft, vandalism, and some natural disasters.

Example: A fire damages your office and inventory. Property insurance helps pay for repairs, replacements, and even lost income during downtime.

Some versions of this coverage include business interruption insurance, which compensates you for lost revenue if you have to shut down temporarily – providing valuable peace of mind during unexpected setbacks.

How do I choose the best insurance provider for my roofing business?

Choosing the right roofing insurance provider is just as important as choosing the right policy. Here’s what to look for:

- Industry experience: Choose a company that specializes in insurance for roofers or construction trades.

- Custom coverage options: Look for providers that let you build a policy around your unique risks and needs.

- Strong financial rating: A-rated companies are more reliable and more likely to pay claims quickly.

- Transparent terms: Avoid vague exclusions or complicated jargon – your provider should be clear and upfront.

- Responsive customer service: Fast claims processing and 24/7 support can make all the difference during a crisis.

Tip: Consider working with a broker who understands the specific needs you have with roofing business insurance. They can help you compare quotes and find the best fit.

The cost of roofing insurance – and what affects it

Insurance for roofing businesses typically ranges from $100 to over $500 per month, but pricing isn’t one-size-fits-all. Your final rate depends on a mix of risk factors, business operations, and the coverage you choose. Understanding these variables can help you budget better – and find ways to lower your premium.

Here’s what impacts the cost of roofing insurance:

- Location and local laws: Insurance rates vary by state and city. Regions with higher accident rates, stricter regulations, or frequent weather-related claims (like hurricanes or hailstorms) tend to have higher premiums. Some states also have mandatory minimum coverage levels that can increase the base cost.

- Crew size and payroll: The more employees you have, the higher your workers’ compensation premium. Insurers use your total payroll to calculate risk exposure – so if you’ve recently added to your team, expect your rate to adjust accordingly.

- Claims history: If you’ve filed multiple insurance claims in the past, your business may be seen as higher risk, resulting in higher premiums. A clean history can lead to discounts and better policy options.

- Annual revenue: Higher income can signal more projects, more job sites, and more potential liability. Insurers may adjust pricing based on your earnings and business growth, especially for larger commercial operations.

- Type of roofing work: Not all jobs carry the same risk. Residential roofers may pay less than contractors doing high-rise commercial work or flat roofing with hot tar. Specialized services like solar panel installs or historic restoration can also impact your premium based on complexity and exposure.

Bonus tip: Using professional-grade software tools for roofing to track jobs, safety incidents, and crew activity can help you build a more accurate risk profile – potentially lowering your rate over time.

Ways to reduce your roofer insurance costs:

Need help finding ways to lower your costs?

Here are some proven strategies for reducing your roofing business insurance expenses while still staying protected.

- Bundle your policies: Many providers offer discounts for bundling liability, auto, and property insurance.

- Raise your deductible: A higher deductible can lower your monthly premium – just make sure you can cover it in the event you need to file a claim.

- Maintain a clean record: Fewer claims = lower risk = lower premiums.

- Train your crew: Documented safety training can sometimes reduce your workers’ comp rates.

- Use software tools for roofing: Efficient documentation and scheduling software can reduce errors and help with claims tracking.

How to ensure you get the right coverage

Writing a smart roofing insurance policy means balancing risk and cost.

Follow these steps to ensure you get the right coverage for your roofing business:

- Assess your risks: Think about common job hazards, customer concerns, and what’s required for licensing or contracts.

- List your assets: Include all tools, vehicles, properties, and equipment you own.

- Choose core coverage: Start with general liability, workers’ comp, and commercial auto.

- Add optional protection: Consider property, professional liability, or umbrella coverage based on your business model.

- Set realistic limits: Low coverage saves money in the short term but can cost you more in the long run.

- Review regularly: Revisit your policy each year, especially if your business grows or your service area changes.

Run your roofing business smarter with Thryv

Great roofing insurance protects your business from risk. Great software helps it run better every day.

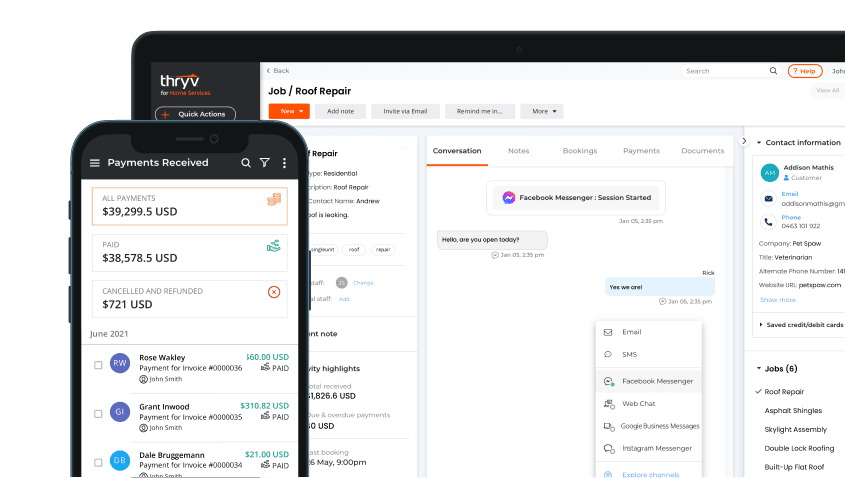

Thryv’s industry-leading market and sales software is built for service pros like roofers, combining powerful business tools into one easy-to-use software. Whether you’re on a roof, in your truck, or at your desk, Thryv helps you stay organized, responsive, and in control.

Here’s what you can do with Thryv:

- Send estimates, invoices, and payment links from the job site or your phone – helping you get paid faster and reduce paperwork.

- Manage your schedule, appointments, and crew in a centralized calendar that syncs with your customers and staff.

- Track customer details, job history, and communication records with a built-in CRM designed to simplify follow-ups and repeat business.

- Automate email and text marketing campaigns to stay top of mind with leads and past customers.

- Store important documents like contracts, warranty forms, job site photos, and insurance policies.

- Accept digital payments on the spot – including credit cards and ACH – speeding up cash flow.

- Enable online booking so customers can request appointments 24/7.

- Use a secure customer portal that lets customers review quotes, send messages, and manage their services.

- Consolidate all communication – email, SMS, Facebook, website chat – into one easy-to-manage inbox.

- Monitor your online reviews and request feedback to boost your reputation.

- Connect with your favorite tools – including QuickBooks, Google Calendar, Outlook, and more – for seamless integration.

- Access real-time analytics and reporting to track revenue, job performance, and marketing ROI.

Thryv keeps everything in sync – so you spend less time buried in admin work and more time building roofs, serving customers, and growing your business.

It’s a smart, scalable solution for any roofer that’s growing a business. Whether you’re managing jobs solo or running a full crew, Thryv helps you stay lean, responsive, and one step ahead.

Additional Resources

Small Business Software for Roofing Businesses

How To Start a Roofing Business: The Complete Guide

11 Roofing Marketing Strategies to Help Earn More customers