Running a plumbing business means rolling with the unexpected — both on and off the job site. Whether you’re fixing a leaky faucet or replacing an entire system, you have enough to think about without worrying about what happens if something goes wrong. That’s where plumbing insurance comes in.

The right plumber insurance doesn’t just protect your business — it gives you peace of mind, helps you stay compliant, and builds trust with customers. Let’s break down how to choose the best insurance for your plumbing business and make sure you’ve got the coverage you need to keep everything flowing smoothly.

What plumbing insurance covers — and why it matters

Plumbing insurance refers to a set of coverages that protect your business from the unexpected. From damaged property to workplace injuries, these policies act as your financial safety net, helping you avoid costly out-of-pocket expenses that could derail your business.

Depending on the size and structure of your company, your plumber insurance policy may include one or more of the following types of coverage.

General liability insurance for plumbers

This is the foundation of most plumbing business insurance plans. It covers accidental damage to customer property and third-party injuries. For example, if you’re replacing a water heater and a misstep floods the customer’s finished basement, general liability can help cover repair costs. It also applies if a homeowner trips over your equipment and needs medical care.

Workers’ compensation insurance

If you have employees, this insurance is likely required by law. It covers medical expenses, rehabilitation, and lost wages if someone gets hurt on the job. Say an apprentice cuts their hand while using a pipe cutter — workers’ comp helps pay for their treatment and time off. It also protects your business from being sued over workplace injuries.

Commercial auto insurance

Your work truck isn’t just transportation — it’s a rolling toolbox. Commercial auto insurance covers vehicles used for business in case of accidents, theft, or property damage. Whether your van is rear-ended at a stoplight or a ladder damages someone’s car while parked, this policy helps cover repair costs and legal claims.

Tools and equipment insurance

Your gear is critical to your business, and it’s not cheap to replace. This coverage helps pay for tools and machinery that are lost, stolen, or damaged. If someone breaks into your van and steals your inspection camera and drain auger, plumber insurance with equipment coverage has you covered.

Commercial property insurance

If you rent or own a workspace, this protects the physical location and everything inside — inventory, tools, materials, and office equipment — from fire, storms, vandalism, or theft. Even if you operate from your garage, commercial property coverage can still be worth it to have.

Professional liability (errors & omissions) insurance

Sometimes, customers claim your work caused financial loss, even if the job was done correctly. This insurance helps cover legal fees and settlements if a client sues you for negligence or mistakes. For example, if a miscalculation in a water line reroute leads to structural issues, this policy could come into play.

Do you really need plumber insurance?

Absolutely! Plumber insurance isn’t just a “nice to have,” it’s a must-have. Whether you’re running a solo operation or managing a team of techs, the right plumbing business insurance helps protect your work, your wallet, and your reputation. Here’s why:

1. It keeps you legally compliant.

In many states, having plumbing insurance is a requirement to get or renew your business license. When you’re applying for your business license, general liability coverage is usually one of the first things they’ll ask for. Skip it, and you could lose the ability to operate legally.

2. It helps you land better jobs.

Homeowners, contractors, and commercial property managers all want one thing: a plumber they can trust. Proof of plumber insurance shows you’re serious about your work and you’re prepared for the unexpected. In many cases, you won’t even be considered for a job — especially larger or government projects — unless you can show proof of coverage.

3. It protects your business from costly claims.

Accidents happen. A small mistake on the job could lead to thousands of dollars in property damage or medical bills. Without plumbing business insurance, that money has to come from you — out of pocket. Insurance helps cover those costs, so a single slip-up doesn’t put your business at risk.

4. It safeguards your tools, your vehicle, and your team.

Plumbing work depends on reliable tools, safe vehicles, and (if you have one) a dependable crew. If something goes wrong — a stolen van or a job site injury, for example — insurance for plumbing business operations can help you bounce back fast and avoid long, expensive disruptions.

5. It gives you peace of mind.

Running a plumbing business comes with enough pressure already (hello, 3 a.m. emergency calls). Knowing you’re protected by the right plumber insurance lets you focus on the job — without second-guessing every “what if.”

How to choose the right provider

Not all insurance companies are built with plumbers in mind. Some are more familiar with coffee shops than crawl spaces — which means they might not understand the unique risks of running a plumbing business. When you’re shopping for plumbing insurance, it’s important to find a provider that gets the ins and outs of your trade.

Here’s what to look for.

- Industry-specific coverage: Choose a provider that offers insurance for plumbing businesses specifically, not just generic small business insurance. The risks you face on a job site are different from those of a dog groomer or bakery, and your coverage should reflect that.

- Flexible plans that grow with you: Just getting started? Look for affordable, entry-level plans. Running a multi-truck operation? You’ll need more coverage. A good provider will offer flexible plans that can scale as your business grows, without forcing you to start from scratch every time you need to make a change.

- An easy, responsive claims process: When something goes wrong, you want help fast. A smooth, well-reviewed claims process is a big deal, especially when you’re dealing with things like water damage, injured workers, or stolen tools.

- Solid customer reviews from other contractors: Other trade pros are your best reference. Check online reviews and ask around to see which providers other plumbers trust. Happy customers usually mean fewer surprises when you need help most.

Take your time to shop around. Get quotes from a few companies, ask lots of questions, and compare not just the price, but what’s actually included in the policy. A cheaper plan isn’t always the better value if it leaves gaps in your protection.

How much does plumber insurance cost?

The cost of plumber insurance varies based on a few key factors: your business size, where you operate, how much coverage you need, and whether you have employees or subcontractors. A solo plumber working residential jobs in a small town will likely pay a lot less than a larger company handling commercial builds in a major city.

On average, most small plumbing companies can expect to pay:

- $500 to $1,000 per year for basic general liability insurance

- $1,000 to $2,000+ annually for more comprehensive plumbing business insurance bundles that include commercial auto, tools and equipment coverage, and workers’ comp

Other cost factors include:

- Claims history (fewer claims = lower premiums)

- Coverage limits (higher limits = higher cost, but also better protection)

- Policy add-ons (like errors and omissions or umbrella coverage)

Save money without cutting corners

Let’s face it — insurance isn’t the most exciting line item on your business budget. But the good news? There are smart ways to keep your plumbing business insurance affordable without sacrificing coverage where it counts.

Here’s how to protect your business and your bottom line.

- Bundle policies for better rates: Many insurers reward you for simplifying. If you combine multiple types of coverage — like general liability, commercial auto, and tools and equipment — into one bundled plan, you can often unlock a discounted rate. It also makes your paperwork easier to manage and ensures all your plumber insurance policies work together.

- Invest in safety and training: Fewer accidents mean fewer claims, and fewer claims usually lead to lower premiums over time. Regularly train your team on job site safety, equipment handling, and vehicle use. Even small changes, like labeling gear or maintaining clean vans, can reduce risks and boost your insurer’s confidence in your operations.

- Review your policy every year: Your business isn’t static — your insurance shouldn’t be either. If you’ve added a new truck, hired a new apprentice, or expanded into commercial jobs, your coverage should reflect those changes. Reviewing your plumbing insurance annually ensures you’re not overpaying for coverage you don’t need or leaving gaps that could cost you later.

- Document everything: Keep detailed records of jobs, equipment maintenance, and safety protocols. If a claim does happen, strong documentation can help you resolve it quickly — and show your provider that you’re running a well-managed, low-risk operation.

Why plumbers choose Thryv

Once your plumbing business insurance is in place, the next big step is building a business that runs smoothly — and grows without adding more stress. That’s where Thryv®’s software comes in.

Thryv offers comprehensive software for plumbing businesses that combines nearly all the tools you need to market, sell, and grow — all in one easy-to-use solution. Whether you’re just learning how to start a plumbing business or managing a busy crew, Thryv helps you stay organized, get discovered online, and deliver a better experience to your customers.

Here are just a few ways that Thryv supports your day-to-day:

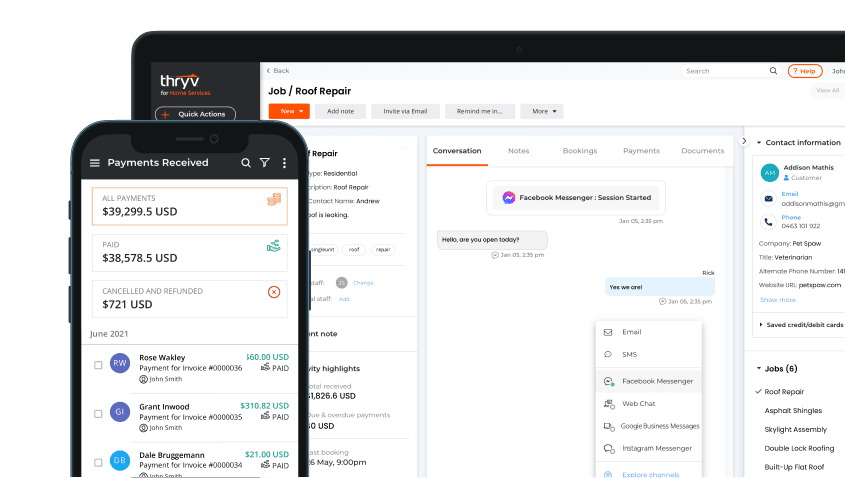

- A mobile app that keeps your business in your pocket: Manage jobs, send invoices, schedule appointments, and respond to leads on the go. Thryv’s mobile-first design means you don’t have to wait until you’re back at the office to get things done.

- Professional online presence tools: Thryv helps you keep your info updated across Google, Facebook, Yelp, and more — so customers can find you fast.

- Online scheduling and real-time appointment updates: Let customers book directly from your website or social media 24/7.

- Easy invoicing and fast, secure payments: Create branded quotes and invoices in seconds, accept payments online or in person, and track everything in one place.

- Customer relationship management (CRM): Keep all your customer info in one secure, searchable place — notes, job history, photos, documents, and more.

- Automated review requests and reputation management: After each job, Thryv can automatically ask for reviews and post them to top sites for you.

- Built-in marketing tools: Send email and text campaigns to promote seasonal services, slow-season specials, or referral incentives.

Thryv also offers free tools for plumbing business owners, including solutions for tracking inventory, generating estimates and invoices, calculating job costs, and tracking all your jobs.

Additional resources

16 Plumbing Tools Every Professional Plumbers Needs

Plumbing Cost Calculator: Job Price Calculator for Plumbers

How to Get a Plumbing License Certifications Requirements