Win more customers with credit card software for small business

When it comes to paying for goods and services, customers today are going digital. A recent survey suggests that customers strongly prefer digital payments like credit cards, digital wallets and smartphone apps over cash or check. Customers appreciate the convenience of these solutions offer, and nearly 3 out of 4 customers say that their decision about where to spend money is influenced by the types of digital payments offered by a business.i

To take advantage of this trend, you’ll need to embrace a variety of online payment solutions and adopt superior credit card software for small business. Even if you provide services in person or sell products from a brick-and-mortar store, offering digital payments can help you capture a bigger share of your market and deliver a better customer experience.

As a do-it-all business management platform, Thryv offers credit card software for small business that enables a broad range of payment types. Along with invoice and estimate software, Thryv’s small business payment solutions help you manage payments and finances more efficiently while improving cash flow and delivering on customers’ expectations.

How to choose the best credit card processing service

You’ll find lots of options when comparing credit card software for small business. Here are a few of the most important things to consider as you make your choice.

- Focus of the business. Some payment processors are focused on serving larger companies and won’t be a good fit for your small business. Look for a merchant services company that is designed for businesses with fewer transactions and smaller average credit card purchases, and one with fees and features that are ideally suited to your needs as a small business owner.

- Total cost of fees. Credit card software for small business comes with a variety of fees, including fees for each transaction, monthly account fees, chargeback and retrieval fees, and early termination fees. To compare the true cost of each merchant’s services, be sure to total all the anticipated fees for a year.

- Equipment needed. Look for a merchant that offers multiple ways to accept credit card payments, including swipe processors, mobile apps and tap-to-pay devices. The more variety, the greater convenience you can offer your customers. Be sure to choose a service that is compatible with the devices you already use or own.

- Service and support. Excellent customer service is essential when you’re trying to resolve payment issues quickly. Look for 24/7 support if you routinely accept payments outside of normal business hours.

Credit card software for small business from Thryv

Thryv’s small business platform provides comprehensive software for running your business more efficiently, communicating with customers more effectively and growing your business more quickly. From marketing solutions for medical practices to estimate software for contractors, Thryv provides the tools that help a broad range of businesses stay organized, automate tasks and streamline processes.

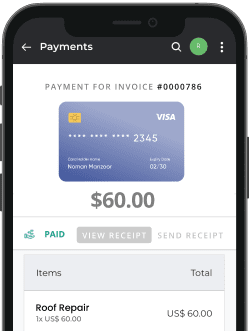

ThryvPay is Thryv’s credit card software for small business, offering easy and secure credit card processing as well as other forms of payment. ThryvPay provides some of the most competitive rates in the industry – with no hidden fees – enabling you to control how much payment processing truly costs your business.

With ThryvPay’s credit card software for small business, you can:

- Swiftly process credit cards at extremely competitive rates.

- Accept ACH payments and bank account transfers to save thousands a year in fees.

- Store credit card info for future or recurring payments.

- Enjoy no extra fees for phone or other card-not-present transactions.

- Automatically charge convenience fees to customers to offset the cost of credit card processing for your small business.

- Make it easy for customers to leave a tip.

- Get next day funding.

- Allow customers to schedule payments in advance.

- Integrate with QuickBooks for automatic reconciliation.

- Process card-present transactions with ThryvPay Mobile Card Reader.

- Process phone-to-phone or card-to-phone transactions with Mobile Tap-to-Pay.

In addition to ThryvPay, Thryv also enables you to get paid via PayPal, Square, Apple Pay, Stripe, Google Pay and other digital payment methods.

More invoicing and payment solutions

Along with credit card software for small business, Thryv offers additional invoicing and payment solutions to accelerate cash flow and streamline processes.

Create interactive invoices

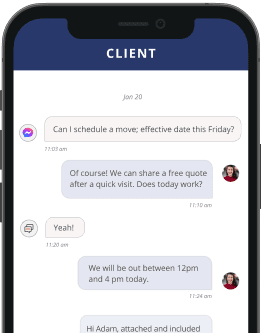

Thryv’s invoice and estimate software lets you build quotes, estimates and invoices quickly, even sending documents from the field. Customers can approve estimates or pay invoices from their mobile devices by simply clicking on a link within an email or text. Thryv’s solution makes it easy to get paid as soon as your work is done and delivers real-time updates on the status of each invoice.

Give customers flexible payment options

With Thryv, you can accept payment at any point in the customer relationship – when appointments are booked, as customers arrive, when your work is finished or at a later date.

Send payment reminders automatically

Thryv automatically reminds customers about upcoming payments and overdue invoices, simplifying collections and improving cash flow.

Offer packages of services

Let customers book and pay for packages of services in advance to generate more revenue and encourage repeat visits.

Scan credit cards any way you want

Thryv lets you scan credit cards with or without a card reader. Scan cards instantly on your smart phone, giving customers a fast and convenient payment experience.

Why choose Thryv?

Providing a single platform that offers do-it-all solutions for small business, Thryv helps business owners stop worrying about managing technology and get back to running their businesses. From estimating software for plumbers to reputation management tools for yoga studios and client portals for law firms, Thryv helps streamline and automate nearly every aspect of running a small business.

Thryv’s cloud-based technology is accessible via any device, from any location at any time. Customizable account access controls and cutting-edge encryption help keep sensitive data and customer information safe and secure. With a single login, business owners and their employees can access all the tools they need throughout the day – no more moving back and forth between multiple applications and platforms. Thryv integrates easily with QuickBooks, Gmail, Indeed, Constant Contact and dozens of other popular business solutions. Unlimited customer support is available 24/7, providing access to live experts with both business experience and technical savvy.